2. Forex Charts Explained.

There are three different Forex charts of use when trading at the Forex Market.

Let me introduce you to them: Line charts, bar charts, and candlestick charts.

We have a strong preference for the candlestick charts because they give us the most information.

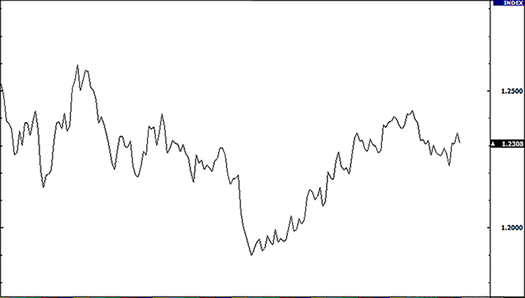

Line Forex Charts

So a chart with just one line the shows us the movement of the quote.

Line charts are easy to read and show us the trend in the Forex charts.

Also good at using to see the Support and Resistance levels.

Although the line chart gives us information about the history of the pairs price, it’s hard to see the individual prices.

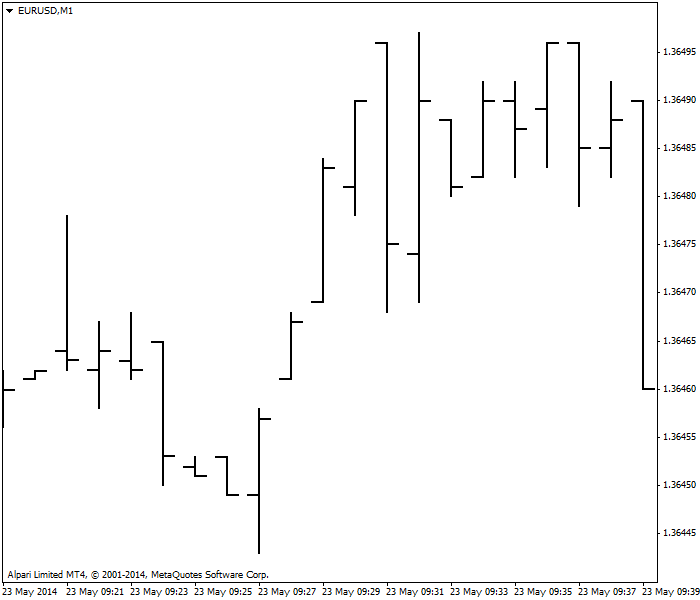

Bar Forex charts

The Bar charts show us individual prices for a certain time period.

Every bar has it’s own information and will so give you a more accurate view of your positions.

The bar has an open, high, low and closing point.

Candlestick Forex charts

Most traders use the candlestick chart because they tell us a lot of clear information.

Especially the Price Action is really recognizable.

Don’t get confused, the candlestick shows us the same information as the bar charts, however, it’s easier to read.

Candlesticks give good information about the highs and lows at a certain timeframe.

Japanese Candlestick Trading

Back in the day when Godzilla was still a cute little lizard, the Japanese created their own old school version of technical analysis to trade rice.

That’s right, rice.

A Westerner by the name of Steve Nison “discovered” this secret technique called “Japanese candlesticks,” learning it from a fellow Japanese broker.

Steve researched, studied, lived, breathed, ate candlesticks, and began to write about it.

Slowly, this secret technique grew in popularity in the 90’s.

To make a long story short, without Steve Nison, candlestick charts might have remained a buried secret.

Steve Nison is Mr. Candlestick.