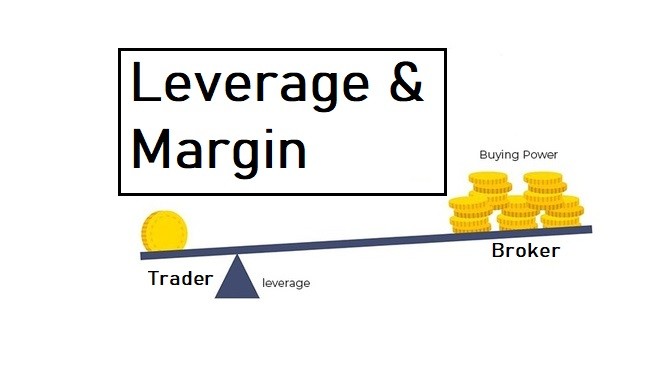

Leverage is perhaps the most overlooked term when it comes to beginner traders trading the forex market. However, it does have the incredible power to grow one’s account massively. By increasing the trade potential, the leverage and margin greatly increase the chances of profit and loss. In fact, the leverage and margin is the amount you get besides the actual balance you have in your account. Before you use them for trade, a deep knowledge of leverage and margin is a must, the use of leverage and margin often increases your risk in account.

The Power of Leverage and Margin:

There are many reasons for the high leverage the forex market provides. The volatility of major currencies in Forex is below 1 per cent on a daily basis. That’s much smaller than an active stock, which is a single day can easily move 5-10 per cent. Through leverage, a smaller change in the market will reap higher returns. Most specifically, leverage enables Forex traders to increase their buying power and make use of less equity for trade. Increasing the leverage obviously increases risk. Essentially, the only aim of Forex trading using margin and leverage is to magnify the possibility of earning a profit by taking greater trading positions then you can eventually deposit your account on your own.

A margin is the sum of money the foreign market broker needs to deposit into a new market trading position. You wouldn’t be able to open a trade and use the leverage without having the marginal amount. The forex trading margin balance is essentially what the broker uses to keep your positions and to cover up any possible losses. Both Forex Leverage and Margin are closely related and, in fact, they are two different paths to determining the full trade value you will take with your current account balance.

Generally, leverage is described using a ratio, e.g. 1:200 or 1:1000. This arrangement states that the trader is able to enter trades in Forex market worth $200 or $1000 for every $1 the trader makes deposits into their account. High leverage rates are to be seen in Forex, as trading is performed on the exchange with the highest daily trading volume of all kinds of trading financial markets. Market Forex Brokers allow their client to take advantage of a higher level of leverage, as it is fairly easy to enter and exit a market trade (liquidity). Considering that liquidity is so strong, Forex traders are in a much easier position to handle their losing positions.

While margin trading can be a more profitable Forex trading strategy, it’s crucial that you take the time to learn how your margin account operates, and make sure to read your Forex broker’s margin agreement. If the available margin in your account falls below a specified level your market positions could be temporarily or fully liquidated. You may not be issued a margin call until liquidating your trade positions. If capital falls below margin requirements in your trading account, your broker can close your some or all of the open positions. It may help to avoid your fund from falling into a credit balance, even in a quick-moving, highly volatile market.