Learn everything about Orderflow trading?

- theforexscalper

Learn everything about Orderflow trading?

theforexscalper

Email us now :

info@theforexscalpers.com

Order flow analysis software

Hello, you must be an order flow trader or you came to this blog because you are curious about trading with the order flow tools.

I myself have been working on this for some time now as most of you know.

I have also written a very strong course on this subject in which you learn everything from A to Z about trading with the Orderflow software.

Also feel free to take a look at “The Whale Order”.

Also I explain exactly which platforms there are and which I recommend to use.

There is also very good software available to use on MT4 and MT5.

Well, let’s go further with which order flow tools are a real must to have.

And what you should especially look at when looking for the right software or platform.

DOM, which stands for “Depth of Market,” provides information about the current buy and sell orders for a specific stock or futures contract.

It shows the volume of orders at different price levels.

A higher volume indicates better liquidity and a more active market.

When the market has greater depth, it tends to be more reliable for making predictions.

In highly liquid markets, a single trade has minimal impact on the overall order flow, unless there is an exceptionally large volume involved.

On the other hand, when trading assets with low liquidity, even a small increase in orders can lead to greater volatility.

It is equally important to know the difference between the 2 types of orders on the market, namely the limit orders and the market orders.

Market Order: A market order is an instruction given by a trader to buy or sell a financial instrument.

At the current best available price in the market. When you place a market order, it will be executed quickly.

But the exact price at which it gets filled may vary.

Market orders prioritize speed of execution over price certainty.

Limit Order: A limit order is an order type where the trader specifies a particular price at which they are willing to buy or sell an asset.

If the market price reaches or surpasses the specified limit price, the order will be executed.

For a buy limit order, the limit price is the maximum amount the trader is willing to pay.

Conversely, for a sell limit order, the limit price is the minimum amount the trader wants to receive.

Limit orders provide more control over the execution price.

But may not be immediately filled if the market price doesn’t reach the specified limit.

The Link between Order Types and the DOM: The DOM (Depth of Market) is influenced by the types of orders placed by traders. If the DOM is dominated by limit orders set far away from the current market price.

Those orders may not get triggered and can provide a misleading picture of the order flow.

It’s important to note that limit orders closer to the market price are generally more reliable indicators of order flow.

Especially for highly liquid assets.

I therefore definitely recommend using the DOM as a tool in addition to your trading.

So that you have a better picture of the major players on the market.

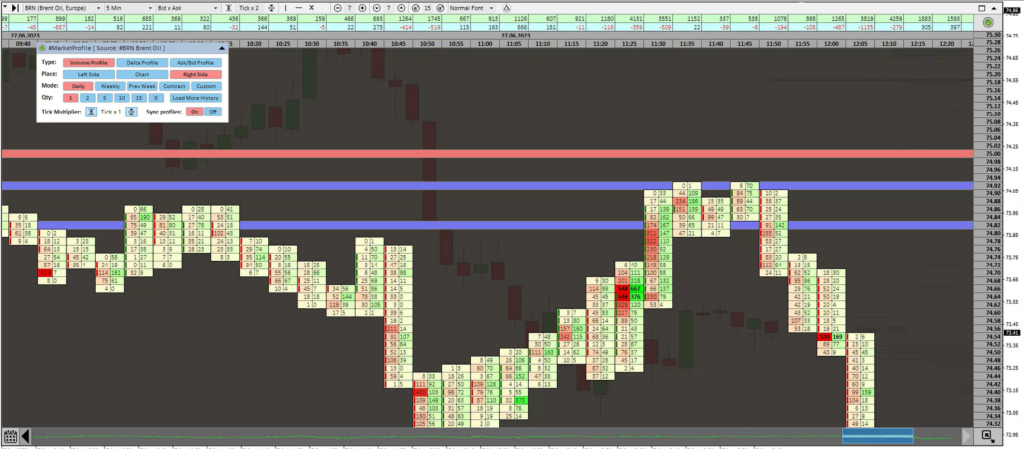

The footprint chart is a popular and useful tool for analyzing order flow. It provides valuable insights by showing only the executed orders, giving a clear picture of market activity.

When you look at a footprint chart, you will see bars that are made up of multiple candlesticks. Each candlestick within a bar is divided into rows, and each row has two columns.

The first column represents buying activity, showing how many contracts or shares were bought at a specific price level. The second column represents selling activity, indicating the number of contracts or shares sold at that price level. By examining these columns, you can determine the intensity of buying and selling at different prices.

The footprint chart helps you understand the dynamics between buyers and sellers, allowing you to see where significant activity and trading volume are occurring.

By using the footprint chart as part of your order flow analysis, you can gain a better understanding of market sentiment and the balance between buying and selling pressure. It can enhance your trading strategy and provide insights that may not be as clear when using traditional candlestick charts alone.

Delta is a crucial concept in order flow trading that provides valuable insights into the imbalance between buying and selling pressure in the market. It is a measure of the net difference between the volume of executed buy orders and sell orders at a given price level.

Overall, incorporating delta analysis into order flow trading allows traders to gain a deeper understanding of market dynamics, identify potential reversals or breakouts, uncover hidden patterns, and improve risk management. It complements other order flow tools and strategies, empowering traders to make more informed decisions based on the imbalance between buying and selling pressure in the market.

Okay of course there are many more order flow tools that you can use in your trading. I also discuss all of these in my latest book + course The Whale Order. I also discuss the very best software and platforms there!

So are you seriously interested in learning order flow trading? I will definitely recommend you take a look there.

Are you looking to take your trading skills to the next level? Or want to know more about Order flow analysis software?

Look no further!

Our comprehensive trading courses and dynamic community provide the resources and support you need to succeed in the financial markets.

Our experienced instructors will guide you through the fundamentals of trading and help you develop a personalized strategy that suits your goals and risk tolerance.

By joining our community, you’ll have access to a network of like-minded traders who are dedicated to helping you achieve your goals.

Our members-only slack provide the perfect platform to exchange ideas, discuss market trends, and collaborate on trades.

Don’t wait any longer to start achieving your trading dreams.

Join our courses and community today and take your skills to the next level!

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker. They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.

Welcome to my author blog. With over 12 years of experience in the financial markets, Trading is more than a profession for me; it's a passion that has fueled my curiosity and determination. Over the years, I've explored various trading strategies, dabbled in different asset classes, and navigated through the ever-evolving landscape of technology and innovation. Through it all, I've witnessed firsthand the transformation of the financial industry. My mission is to share the wealth of knowledge I've gained over the years with you, my fellow traders and aspiring investors. Whether you're a seasoned pro looking for fresh perspectives or a newcomer eager to understand the basics, you'll find something valuable here.

Use Code: PRACTICUM50

Join now and take the first step towards mastering your skills. Don’t miss out on this limited-time offer!

Start Your Journey Today!

Get 15% off on any item when you buy today