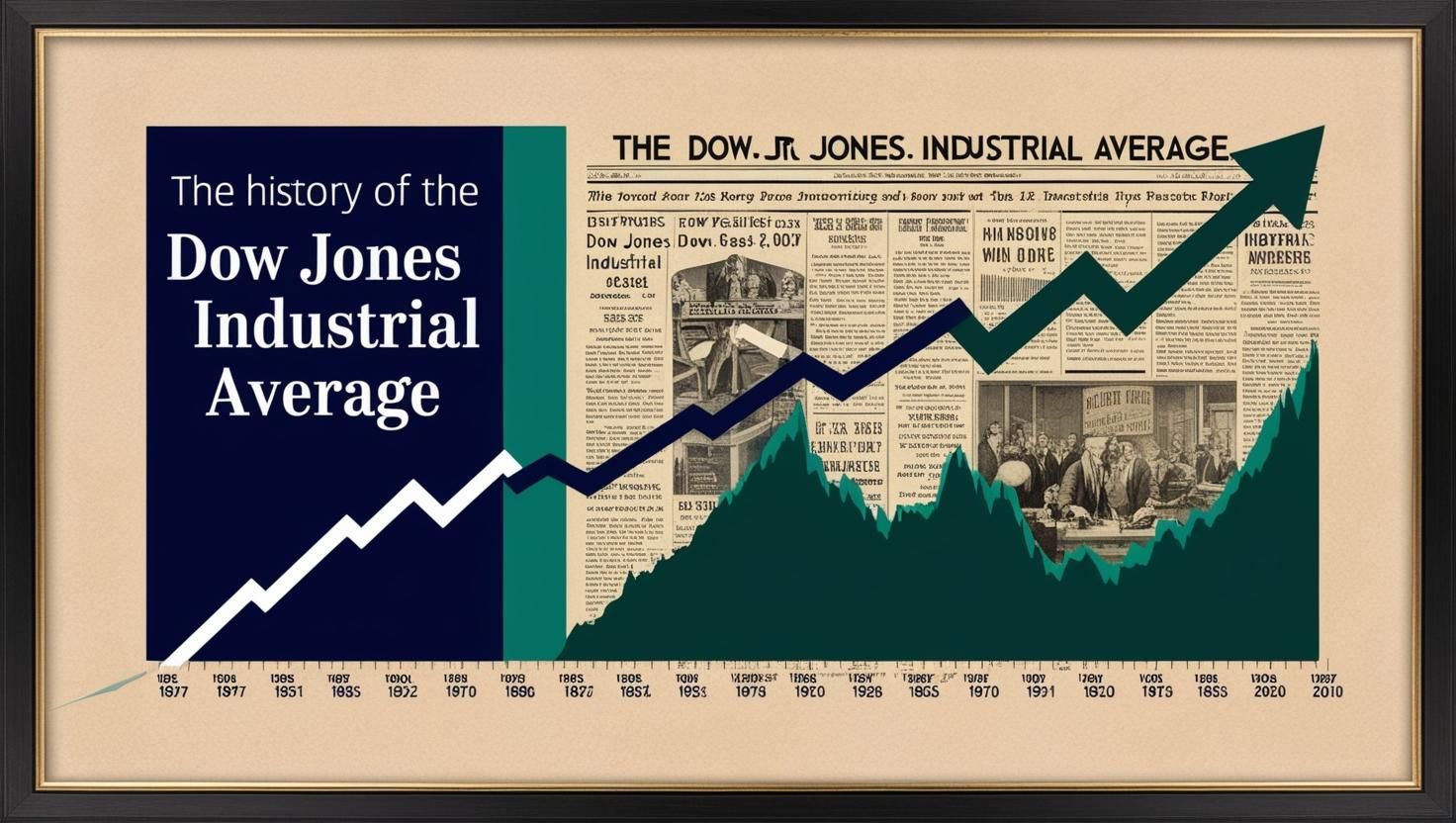

Dow History: The Evolution of the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is one of the most widely recognized stock market indices in the world. Therefore, understanding Dow history is essential for investors looking to analyze past market trends and anticipate future movements. This article explores the Dow’s historical data, record highs, and its long-term growth patterns, providing a deeper understanding of market behavior.

How Much is the Dow Jones Worth Today? Dow History.

The Dow Jones Industrial Average fluctuates daily based on economic conditions, corporate earnings, and global market trends. Investors frequently ask, “How much is the Dow Jones worth today?” Because of constant market movements, the index’s real-time value is available on major financial platforms. Additionally, historical tracking provides insights into long-term performance, helping investors make more strategic decisions.

Dow Jones Historical Data: Tracking Growth Over Time

Understanding Dow Jones historical data helps investors assess market cycles and performance over the years. Consequently, analysts study stock market charts historical reports to recognize patterns and identify potential trends.

Key Historical Milestones: Dow History.

- Dow Jones Record High: The DJIA all-time high was recently achieved, reflecting economic growth and increased investor confidence.

- Dow Highest Ever: Investors track the Dow Jones highest ever to measure peak market valuations and potential future growth.

- Stock Market Graph Last 5 Years: A Dow Jones 5-year chart showcases medium-term performance trends and market shifts.

- Chart of DJIA for 10 Years: A 10-year chart of Dow Jones illustrates broader market cycles, offering a clearer picture of economic stability.

- Chart of DJIA for Past 20 Years: A 20-year chart of the DJIA highlights long-term economic growth and major financial events.

Where Was the Dow 4 Years Ago?

A frequent question among investors is, “What was the Dow at 4 years ago?” or “Where was the Dow 4 years ago?” Market cycles, economic policies, and global events all contribute to shifts in the Dow Jones Industrial Average history chart.

Tracking historical market data allows investors to compare past trends with current performance. For instance, asking “What did the Dow close at 4 years ago today?” helps in assessing economic resilience over time. Additionally, reviewing this data helps traders make informed predictions about future trends.

Dow Jones Industrial Average All-Time High

The Dow Jones all-time high remains a benchmark for economic strength and stability. Investors consistently monitor record highs to gauge the stock market’s potential. Furthermore, the Dow Jones average record high signals strong corporate earnings and increased investor optimism, which can indicate future economic growth.

Dow Jones Chart 70 & Historical Market Trends

Investors studying long-term trends analyze the Dow Jones chart 70 to understand historic bull and bear markets. Additionally, the historical chart of the Dow Jones Industrial Average provides insights into economic expansions, recessions, and financial recoveries. These insights are essential for long-term investors aiming to make strategic decisions.

Dow Jones Performance Over the Last 10 Years

Investors tracking long-term trends analyze:

- Chart of Dow Jones Industrial Average Over Past 10 Years

- Dow Jones Last 10 Years

- Historical Dow Averages

These indicators help determine how much is the Dow Jones up for the year and how recent movements compare to past trends. Additionally, reviewing Dow Jones 5-year chart and 10-year chart of Dow Jones data helps investors identify potential patterns and opportunities.

Additional Resources

For traders looking to improve their market knowledge, consider enrolling in our Order Flow Masterclass and Supply and Demand Trading Course at The Forex Scalpers.

If you’re searching for a reliable broker, we highly recommend IC Markets: Sign Up Here.

Additionally, check out our Order Flow Trading eBook for valuable insights: Download Here.

Conclusion: Understanding Dow History

Studying Dow history provides valuable insights into economic cycles, market growth, and investment opportunities. Whether examining the Dow Jones 4 years ago, the Dow highest ever, or the chart of DJIA for past 20 years, historical data helps investors make informed decisions about future market movements. Furthermore, analyzing trends allows traders to develop strategies that align with the market’s long-term trajectory.