The forex trading psychology has a great deal to do with a trader’s instinctual market reaction. Uncontrollable emotions are possible in a changing trading environment particularly during market movement. The emotions that go unchecked can often lead to unpredictable results. If your strategy determines holding on to or closing a trade, emotions may cause different reactions that may affect performance. With lots of information coming in, forex traders need to master how to handle emotions, particularly when challenged.

Emotions are an important part of human nature. They can express themselves as positive or negative sentiments. Since a trader is first of all a human being, emotions will interfere with the direction of the trade. Learning how to manage them is important to prevent their being a obstacle to your success. Without a question, emotions are among the most important variables for traders, and how traders treat emotions in their trade determines whether or not they will be successful in the long term.

The psychological aspect of forex trading is essential, and the reason for this is quite simple: traders are often forced to make quick decisions in and out of forex trading on short notice. They need a certain presence of mind to accomplish this. They do need discipline by extension, so they adhere to previously developed trading strategies and know when to book profits and losses.

Why should a forex trader ever start violating its own trading rules after going through the trouble of developing and enforcing a trading plan? When people struggle in forex trading, they accuse their costly trading systems and mentors, and some will even go ahead to accuse their forex broker or trading system, but the main issue is emotions in the real sense. Some traders who don’t understand that emotions play an important role in life and will go ahead to change their trading system, broker and mentor but the losses will increase.

======================

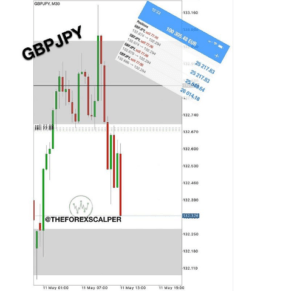

Results – Instagram

======================