Understanding how to pin bars will help a trader to catch entries just as power balance changes between the sellers and buyers. Forex Trading pin bars are one of those easily learnable forex trading techniques and is perfect for swing trading because you could have found a turning point in the market. You can pull up any currency trading chart to see how, by using some form of candlestick pattern, a pin bar reversal will always illustrate significant turning points as a higher timeframe brings more weight than a low timeframe.

Learning how to trade pin bars is one of the main skills that you need to learn as a trader as they are one of the most popular patterns of price action that you can see on your Forex charts. Fortunately, trading pin bars alone isn’t that difficult and just allows you to have a slight amount of information about why pin bars are emerging in the forex market, which you can easily learn by reading my article on understanding pin bars.

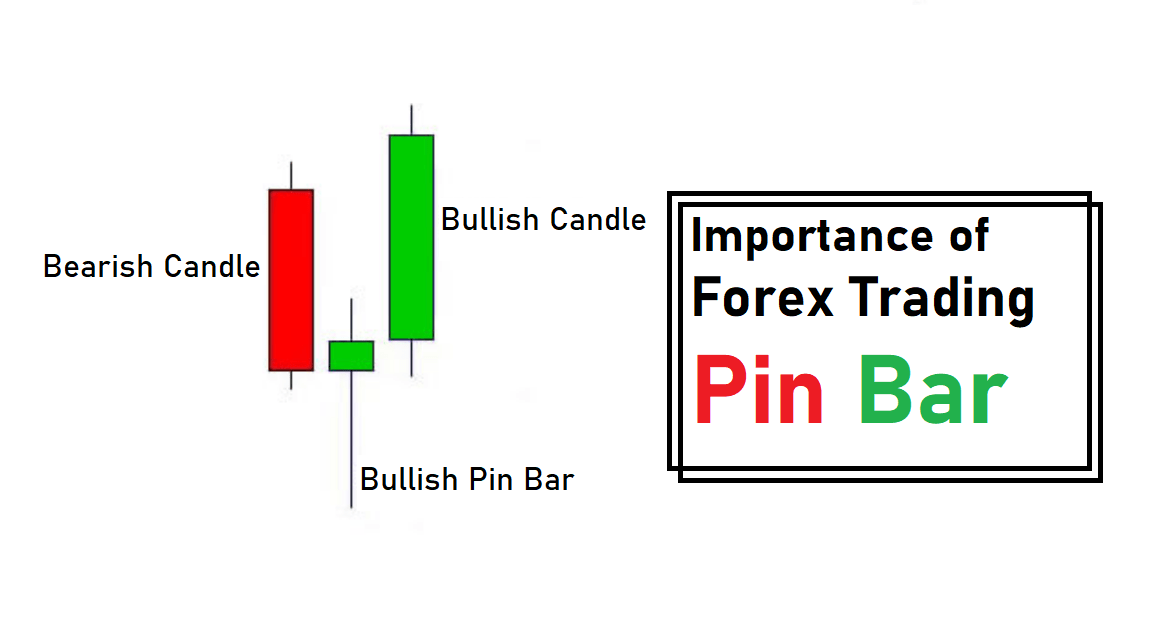

The secret to profiting from the pin bars is to recognise pattern continuation or reversal in advance. A pin bar may usually stay out of price action, with the pin wick being at least twice the length of the candle body. Typically, you can define the meaning by looking at previous price behaviour near to pin bar price. If the pin bar is going high or low than the recent price action or no recent price action is taking place, it is most definitely a reversal true pin bar.

A pin bar strategy is based on a basic but established premise that forex pairs during a rally come into resistance, but are always able to smash through it. Once this happens, the former resistance changes into fresh support. In the process, a bullish pin bar is created when the market finds support at previous resistance. The configuration of a pin bar is a simple way to imagine market trend reversals. When used correctly it could be your ticket in the future for more successful trades.

The perfect timescales for trading in pin bars are 4H hours, D daily and W weekly. Market Trading pin bars in combination with several other price action techniques such as trend lines and swing analysis is often the best choice. A pin bar is much more stable if it appears near any essential support or horizontal level. In conclusion, with good money management, it is suggested to trade pin bars on higher timelines preferably on 4H, daily & weekly. Therefore, only counter-pattern pin bars produce reversal signals, avoiding trading pin bars that appear within the same pattern.

Questions?

Questions?