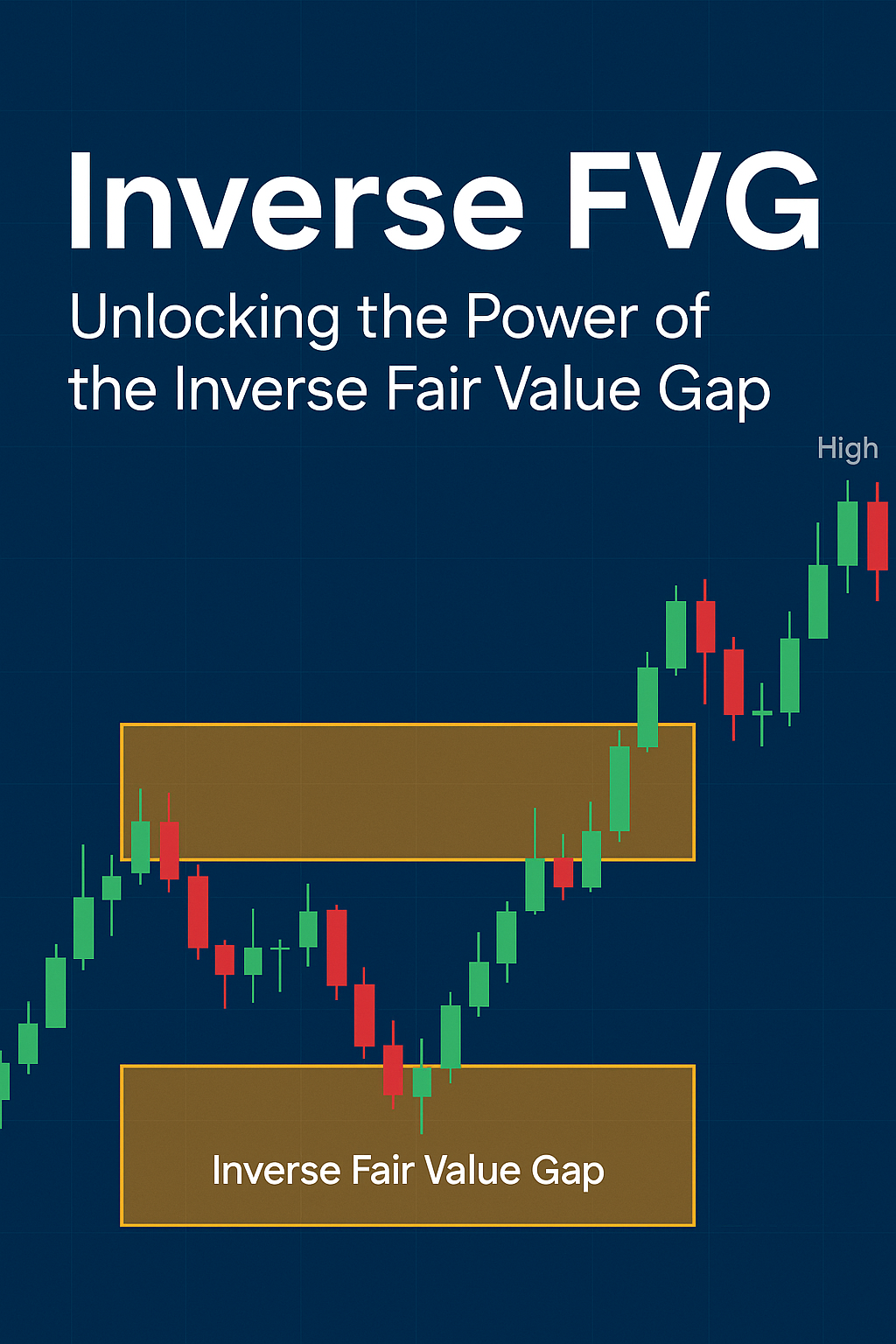

Inverse FVG: Unlocking the Power of the Inverse Fair Value Gap

In smart money and price action trading, most traders are familiar with the concept of a Fair Value Gap (FVG). But fewer know about its opposite—the Inverse Fair Value Gap, or Inverse FVG.

This lesser-known yet powerful concept can help you recognize how price manipulates key levels before reversing. When used correctly, it provides strong confluence with structure, liquidity grabs, and order flow.

In this blog, you’ll learn:

-

What an inverse fair value gap is

-

How to identify inverse FVGs on your chart

-

The difference between a regular FVG and an inverse one

-

How smart money uses these zones to trap retail traders

-

How to include inverse FVGs in your strategy

What Is an Inverse FVG?

An Inverse Fair Value Gap is a deceptive price zone. It occurs when price returns to a previously formed FVG, appears to fill it normally, but then quickly rejects the level and reverses direction.

While a standard FVG signals a rebalancing zone, an inverse FVG is a trap. It’s created to lure traders into the wrong side of the market. These fakeouts often occur:

-

Just beyond key highs or lows

-

During liquidity sweeps

-

Before a market structure shift (MSS)

Institutional traders use this method to create the illusion of balance—then aggressively reverse price to trap retail traders.

How to Identify an Inverse Fair Value Gap

To spot an inverse FVG, follow these steps:

-

Start with a typical three-candle FVG structure

-

Wait for price to return and fully fill the gap

-

Watch for signs of rejection—wicks, lack of continuation, or reversal

-

Confirm with delta volume, footprint charts, or price reaction

The key clue: price fills the gap, but instead of continuing, it quickly reverses, showing the fill was a trap.

Inverse FVG vs Regular FVG

| Feature | Regular FVG | Inverse FVG |

|---|---|---|

| Purpose | Rebalancing area | Trap and reversal zone |

| Price Behavior | Continuation after retest | Reversal after deceptive fill |

| Trader Response | Buy/sell entries on pullbacks | Stop-outs and failed entries |

| Timing | After break of structure | Around liquidity sweeps or fakeouts |

An FVG shows where price will likely return. An inverse FVG shows where price traps before it reverses.

How Smart Money Uses Inverse FVGs

Institutional traders create confidence for retail by filling gaps and letting price “act normal” temporarily. But as soon as the crowd jumps in, the market flips—quickly.

For example:

-

A bullish FVG is filled

-

Retail traders go long expecting a bounce

-

Smart money reverses the move sharply

-

Long positions are trapped and liquidated

-

The true move (downward) begins

These zones become highly reactive points—used to draw in liquidity and power the real move.

Inverse FVG Trading Strategy

Here’s a simple way to trade the inverse FVG:

-

Identify a filled fair value gap

-

Watch for failed continuation and signs of rejection

-

Confirm the reversal using order flow or structure shift

-

Enter in the opposite direction of the original FVG

-

Set stop loss just beyond the trap wick

-

Target the next imbalance, liquidity zone, or opposing FVG

This setup is especially effective when combined with:

-

Breaker blocks

-

Market structure shifts (MSS)

-

High-volume sessions (e.g., NYSE or London open)

Real-World Examples

Bearish Inverse FVG:

-

Price fills a bullish FVG

-

Retail longs enter on the pullback

-

Price stalls and reverses lower

-

The zone becomes a trap → reversal continues down

Bullish Inverse FVG:

-

A bearish FVG is filled

-

Shorts enter on resistance

-

Price suddenly breaks higher

-

Shorts are trapped → price accelerates upward

Want to Master This Concept?

To use inverse FVGs effectively, you must understand how structure, imbalance, and order flow come together. These tools will help:

Supply & Demand Trading Course

Master the foundational concepts: OBs, FVGs, MSS, and institutional levels.

Start learning here

Orderflow Trading Masterclass

Use footprint charts, delta volume, and flow confirmations to validate inverse zones in real time.

Join the masterclass

Use a Broker That Supports Precise Execution

To catch fast-moving traps and reversals, you need speed and precision. That’s why we recommend:

IC Markets

-

Raw spreads from 0.0

-

Fast execution on MT4, MT5, and cTrader

-

Ideal for smart money and FVG-based strategies

Get started with IC Markets

Final Thoughts

The inverse FVG reveals how institutions use imbalance zones to manipulate and reverse price. If you can spot the difference between real fills and fakeouts, you gain a serious edge.

Learn to recognize deceptive fills

Confirm the reversal

Trade with timing and structure

Stop following traps—and start profiting from them.