June 18, 2024 / How Does Trading Order Flow Work with Funded Accounts?

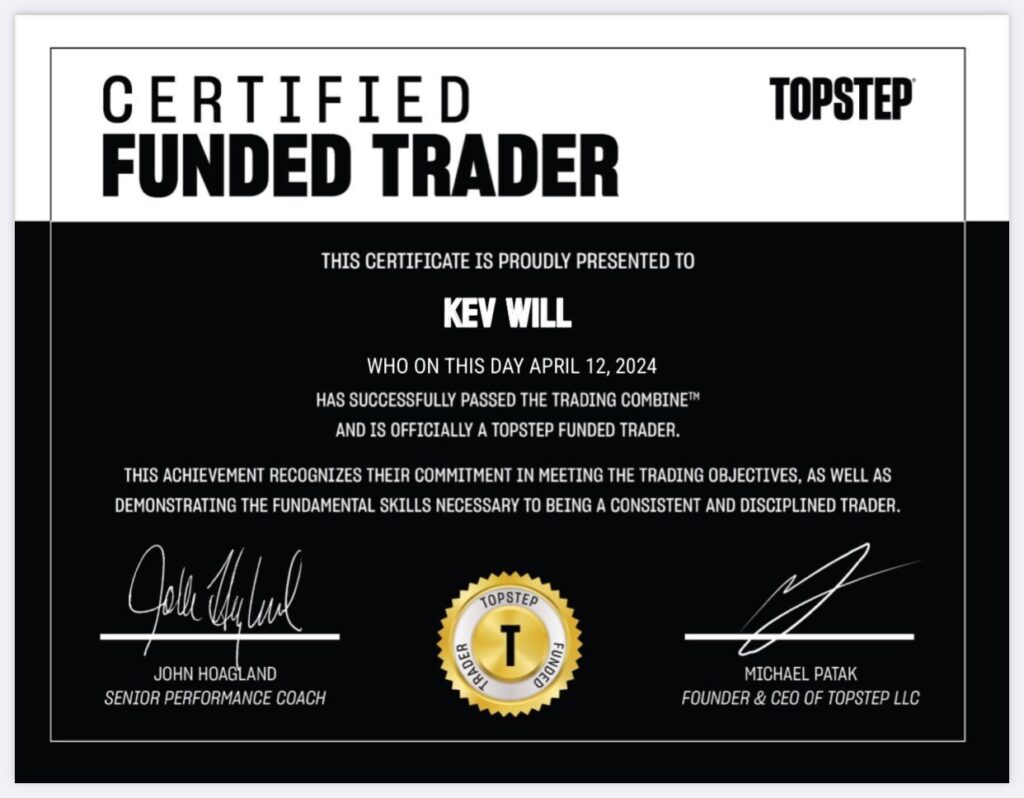

Now that I’ve been trading funded accounts from both Topstep and Apex using my order flow strategy, I’ve learned that it’s a good mix of opportunities and challenges.

For those who might not know, order flow trading is about watching the buying and selling activity in the market in real-time. It helps you understand what’s really going on behind the scenes, which can give you an edge when deciding when to enter or exit a trade. But how does that work when you’re trading with a funded account and have to follow strict rules?

Adapting Order Flow to Funded Accounts

One of the first things I noticed is how important risk management becomes. Prop firms like Topstep and Apex have strict rules—things like daily loss limits, trailing drawdowns, and profit targets. So, even though order flow helps me spot great opportunities in the market, I have to be super careful about not breaking those rules.

With order flow, I sometimes see chances to hold a trade longer or take a bit more risk, but with a funded account, you just can’t do that. You have to be disciplined and stay within the limits, even if the market looks like it’s about to make a big move.

The Benefits of Order Flow with Funded Trading

Even with the restrictions, order flow is still really helpful for funded trading. It gives me a clearer idea of when to get in and out of trades. If I see a strong imbalance in the market, I can time my entries better and take advantage of high-probability moves. This precision is super important when I’m working within the strict rules of a funded account.

For example, when I see big orders piling up, I know the market is likely to react. Instead of holding out for a huge profit, I’ll take smaller wins to stay within my daily limits or protect my account from the drawdown. Order flow helps me trade smart and manage risk while still catching good moves.

Challenges of Using Order Flow with Funded Accounts

But it’s not all easy. One of the hardest parts is knowing when to hold back. When I see a big move forming in the order flow data, I want to go all in, but the prop firm rules force me to be cautious. I’ve missed some big opportunities because I didn’t want to risk breaking the daily loss limit or other rules. In those moments, I remind myself that keeping the account safe is more important than chasing profits.

Another challenge is dealing with the emotions that come with it. Sometimes, I close trades too early because I don’t want to lose the progress I’ve made. Order flow helps me read the market better, but it doesn’t remove the pressure of staying funded.

Finding the Right Balance

At the end of the day, trading order flow with a funded account is all about balance. Order flow gives me a big advantage because I can make more accurate decisions. But the funded account rules mean I have to stay disciplined and take smaller, safer trades. It’s not about hitting huge wins; it’s about being consistent and keeping the account alive.

What’s Next?

For now, I’m focused on refining how I use order flow in my funded accounts. The goal is to grow the account steadily while following the rules. The challenge isn’t just about reading the market—it’s about managing myself.

I’ll keep sharing updates as I continue this journey and learn more about how order flow works in prop firm trading. Stay tuned for more insights as I go deeper into this experiment!

Are you ready to take on a challenge with Apex or Topstep?

Now is your chance to get started! Whether you choose Apex or Topstep, both platforms offer a unique opportunity to prove yourself as a trader without risking your own capital. You can join the challenge here:

Be sure to let me know how your journey goes—I’d love to hear about your progress!