July 18, 2024 / Progress Update: Payouts, Reflections, and Insights

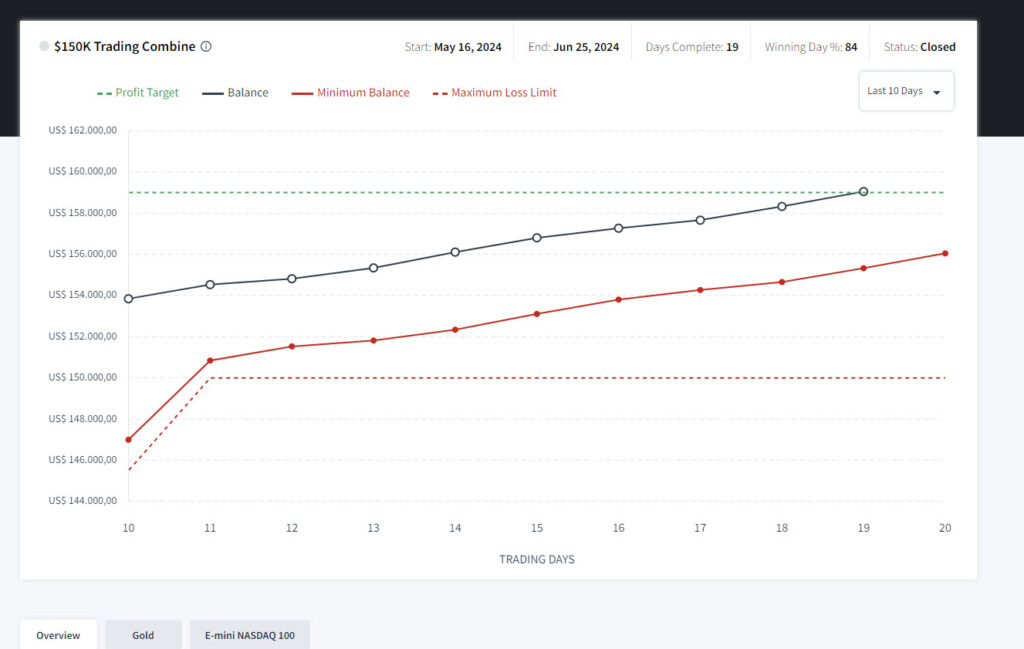

We’re now a bit further into this journey, and I’m happy to report that I’ve already received my first payouts! It’s been a rewarding process so far, and I want to share some of my reflections and results, including my Topstep charts that show exactly how I passed my funded challenges. But there’s also a key question to address—what do I think of all of this so far? And perhaps more importantly, do you really trade with $150,000 on Topstep or $300,000 on Apex? Let’s dig deeper.

Do You Really Trade with $150,000 on Topstep or $300,000 on Apex? / Apex payout

One of the most common questions when starting with a prop firm is whether you’re actually trading with the full amount of capital they advertise. On Topstep, they say you get an account with $150,000, and on Apex, that number can go up to $300,000. These numbers sound impressive, but the reality is a bit different.

Yes, you’re technically working with those amounts in terms of leverage, but it’s important to understand that you’re not trading the full amount in the way you might think. The risk you can take on each trade is tightly controlled by the firm’s rules. There are daily loss limits, trailing drawdowns, and other risk management requirements that limit how much you can lose or risk at any given time. This means you’re not using the full buying power of $150,000 or $300,000 in each trade.

For example, if you have a $150,000 account on Topstep, your daily loss limit might be $3,000. While you can still place trades that reflect larger capital, the risk you take has to stay within those limits. So, in reality, you’re trading more cautiously, focusing on protecting the account and following the firm’s rules rather than taking advantage of the full leverage.

My Experience with Payouts and Maintaining Funded Accounts

Now that I’ve reached the stage of receiving payouts, I can say that it feels great to see the results of the hard work. Passing the challenges was a significant accomplishment, but the real challenge began once I got funded. Many traders think that once you pass the evaluation, you’ve “made it,” but in reality, the hard work starts when you have to maintain the account and make it grow.

One of the first things I noticed after being funded is that maintaining the same discipline I had during the evaluation is critical. It’s easy to become overconfident after passing and start taking bigger risks. But if you stray from the strategy that got you funded, it’s just as easy to lose the account before seeing any real returns. The firms are strict about maintaining risk management, and that’s a good thing—it keeps you in check and prevents you from making emotional or impulsive decisions.

Apex payout

The payouts are rewarding, but they only come when you stick to the plan and remain disciplined. You can’t chase every big trade or take on unnecessary risks. The moment you lose sight of the risk management rules, you’re putting your account at risk. I’ve been steadily growing my account by focusing on small, consistent wins rather than going for home runs. That’s the key to staying funded and receiving payouts over time.

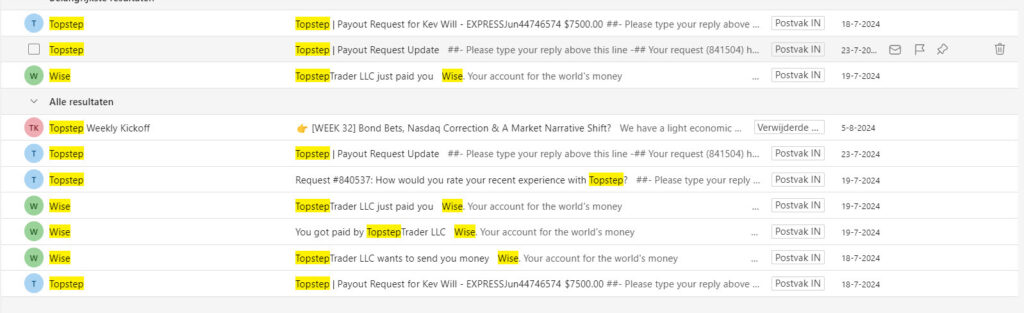

As shown in the screenshot above, I recently submitted a payout request for my Topstep account, and they processed the payment through Wise. I was pleasantly surprised by how quickly it all happened—my funds were in my account within just one day! This level of efficiency is something I truly appreciate, and I want to give credit to Topstep for consistently delivering fast payouts. I’ve never had to wait more than three business days for any of my withdrawals.

Evaluating the Journey So Far / Apex payout

Looking back, I can confidently say that trading with a prop firm is a unique and valuable experience. It has taught me a lot about discipline, patience, and long-term growth. Order flow trading, the strategy I’ve relied on, has worked well within the restrictions of funded accounts, but it’s required a different mindset. In a funded environment, it’s not about making huge profits in a short period—it’s about consistency, risk management, and protecting the account.

The truth is, passing the challenge was just the first step. The real work comes after, when you’re trading day in and day out with someone else’s money. There’s a pressure that comes with that, but at the same time, it’s rewarding to see how discipline and patience pay off in the long run.

I’ve also learned that while the large account sizes ($150,000 on Topstep and $300,000 on Apex) are great for marketing, they don’t represent the full reality of what you’re trading. You need to stay focused on managing risk and making smart, calculated decisions. That’s where the real skill lies.

As I continue this journey, I’m excited to see where it leads. The goal now is to keep growing my funded accounts while sticking to the same principles that got me here.

In the coming weeks, I’ll share more details, including my Topstep charts that show how I passed my challenges. I’ll also dive deeper into the strategies I’ve been using and how they’ve evolved during this journey. Stay tuned!

Are you ready to take on a challenge with Apex or Topstep?

Now is your chance to get started! Whether you choose Apex or Topstep, both platforms offer a unique opportunity to prove yourself as a trader without risking your own capital. You can join the challenge here:

Be sure to let me know how your journey goes—I’d love to hear about your progress!