When it comes to the financial markets, few events stir up as much attention as the Non-Farm Payroll (NFP) report. Traders from around the world eagerly anticipate the NFP release dates, as they can lead to major price movements across various assets, especially in the forex, stocks, and commodities markets.

But what exactly is Non-Farm Payroll, and how does it affect trading? In this blog, we’ll define the NFP, explain its importance, and look at why market conditions change during NFP week, as well as why traders—especially those not focused on news trading—should approach it with caution.

Define Non-Farm Payroll: What Does It Mean?

The Non-Farm Payroll (NFP) report, released monthly by the U.S. Bureau of Labor Statistics, measures the number of jobs added or lost in the U.S. economy, excluding farm workers and certain other industries. The NFP serves as a key indicator of U.S. economic health and is closely watched by economists, businesses, and investors alike.

The meaning of Non-Farm Payroll in business goes beyond just jobs. It’s a reflection of consumer spending power, as more jobs usually mean more income, which translates into higher consumer spending. This report also affects decisions made by central banks, including interest rate adjustments.

Why Is NFP Important to Traders?

NFP reports are significant because they can lead to increased volatility in the financial markets. The NFP news today live can move prices significantly across stocks, forex, and commodities, with the biggest impacts typically seen in the forex markets.

Traders pay close attention to NFP predictions, as the market often prices in expectations leading up to the release. If the NFP expectations don’t match the actual numbers, the market may react sharply.

For example, if the NFP release date shows a higher-than-expected job growth, it could boost the value of the U.S. dollar as it indicates a strong economy. Conversely, a lower-than-expected figure could lead to dollar weakness and cause shifts in other markets such as non-farm payroll stocks.

NFP Trading: Why You Should Be Careful non farm payroll

If you’re a technical trader, you’ll likely notice that during NFP week, price action behaves differently. NFP stocks and forex pairs can show erratic movements as traders try to position themselves before the report is released.

Personally, as a Nasdaq trader, I’ve learned to avoid trading around NFP. Sometimes, several days before the non-farm payroll dates, price action starts to behave abnormally. The usual trading criteria I look for in terms of entry points don’t align as they normally would.

For example, while trading non-farm payroll can be profitable, it’s also high-risk, especially if you’re not a news trader. The increased volatility and unpredictable market reactions mean that even with tight stop losses, you could be stopped out quickly. This is why I often choose not to trade a few days before the NFP release, as I notice the price moving differently toward the end of the week.

Why the Market Moves Differently During NFP

The market moves differently because traders, institutions, and banks are positioning themselves based on their expectations for the report. When NFP predictions don’t match the actual data, we often see a surge in price movement as traders adjust their positions.

Additionally, the non-farm payroll schedule is well-known, and market participants react in advance, which is why you may see changes in price action before the actual release. By the time the NFP release date arrives, much of the market’s initial reaction has already been baked into the price, but the unpredictability of the outcome often leads to sharp movements post-release.

What is Non-Farm Payroll and Its Impact on Forex? non farm payroll

For those asking, “What is Non-Farm Payroll in forex?”, the NFP plays a crucial role in the currency markets. Since the report reflects the economic health of the U.S., it can dramatically affect currency pairs involving the U.S. dollar. Trading non-farm payroll forex can be particularly challenging due to the heightened volatility.

The NFP dates are marked on every forex trader’s calendar because the market can shift dramatically within minutes of the release, leading to both large gains and losses. If you’re not prepared for this volatility, it can be a dangerous time to trade.

The Takeaway: Should You Trade NFP? non farm payroll

If you’re not a seasoned news trader, my advice is to be cautious during NFP week. Often, it’s better to stay on the sidelines if you’re not specifically trading around news releases. Market movements become unpredictable, and you may not see your usual setups.

That said, if you are looking to trade the NFP, make sure to keep an eye on the non-farm payroll calendar and the NFP dates. Understanding non-farm payroll meaning and its implications can give you the edge you need to navigate the volatility, but always remember to use proper risk management strategies to protect your account.

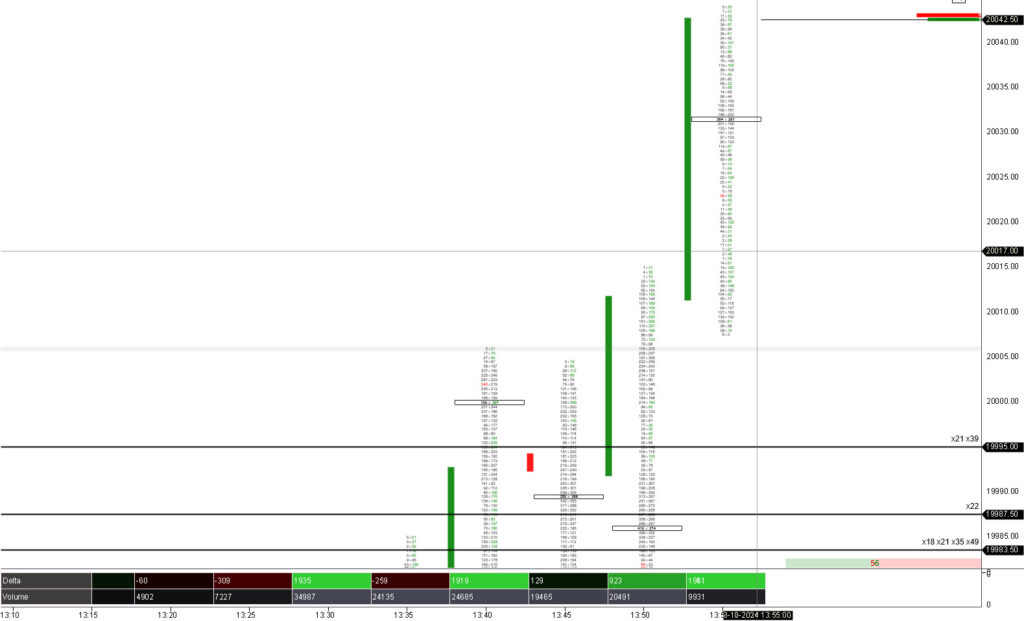

October 3rd, 2024: The Build-Up to NFP and Why I Take a Step Back

As we approach the Non-Farm Payroll (NFP) release, the final three days—Wednesday, Thursday, and Friday—are typically the most unpredictable. The price action leading up to NFP is often different from usual, as we can see once again today. With key news events scheduled for 10 a.m., it’s clear that the entire market is building toward that moment. You can observe the shift in momentum and behavior, whether you’re trading NQ or MNQ, and one thing becomes clear: the delta rollover is in full effect.

Through years of data collection and analysis, I know precisely when to step in and when to stay out. The build-up to major news events like NFP creates conditions that don’t always align with my trading strategy, and the price moves differently than usual. However, the weeks following NFP are often incredibly favorable for trading, providing excellent opportunities to run my model with high consistency.

As a professional orderflow trader, the data you collect is critical. It reveals patterns of when and how you perform best. These insights are key to making informed decisions about when to trade and when to sit on the sidelines.

In this case, we’re approaching a major news event, and the order flow delta tools are still signaling buying power. However, it’s essential to wait for clear signs from the sellers. When we spot a significant footprint imbalance, that’s when the picture becomes clearer, and we can decide if it’s time to engage or continue observing.

Being patient and collecting data during these periods will give you the edge you need to make the right decisions when the timing is right.

Conclusion

The Non-Farm Payroll (NFP) is a major event for traders, especially those focused on the U.S. dollar and other financial markets influenced by economic data. Understanding the meaning of non-farm payroll, how it affects the market, and the risks involved can help you make informed decisions during this volatile time.

For many traders, avoiding trading in the days leading up to the NFP release and the day of the release itself can be a wise strategy. This allows you to avoid unnecessary risk while still keeping an eye on how the markets react to the report.

If you’re thinking of trading the NFP, remember that the market can move unpredictably, and it’s essential to have a solid strategy and risk management plan in place.

Good luck, and trade carefully during NFP week!

Join us

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Discord is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

Elevate Your Trading with ATAS.

So for those dedicated to mastering the art of trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

Looking for a Trusted Regulated Broker?

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker.

They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.