Institutional orderflow

When it comes to understanding financial markets, there are various ways to analyze them.

Some popular methods include momentum analysis, which looks at mathematical indicators applied to prices to understand current market forces, and fundamental bias analysis, which relies on economic data releases.

There are also other methods like standard deviation-based analysis and key levels analysis, which involve looking at levels such as daily pivots, Fibonacci levels, and daily highs and lows.

However, none of these commonly used analysis types fully answer the question of why prices behave the way they do at specific levels.

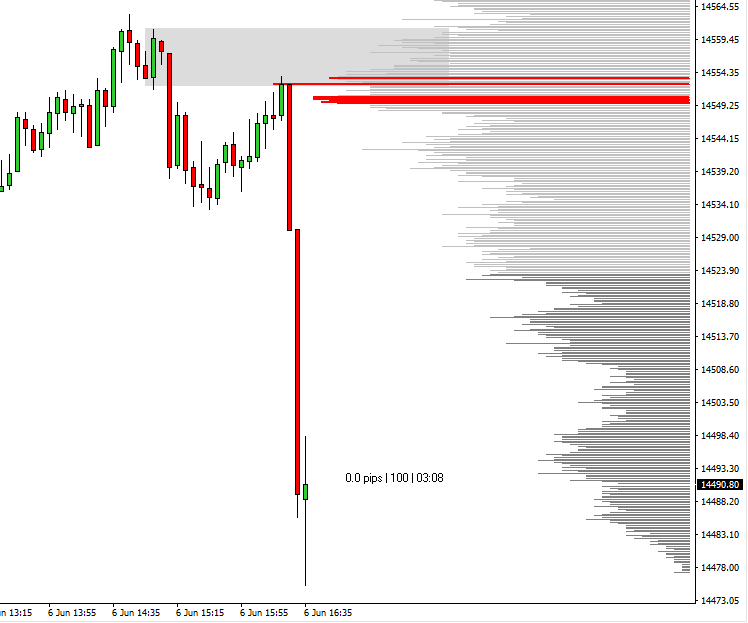

When prices approach a key level, different scenarios can unfold. Price may reverse, briefly retrace and then break the level, break the level decisively, or even give a false breakout known as a fake-out.

Order Flow Analysis offers a unique perspective by providing a reliable definition of key levels and also sheds light on the strength of resistance at those levels.

But before we proceed, let’s understand the concept behind price changes. Prices move because there is an imbalance between the number of buyers demanding the asset and the number of sellers supplying it. This fundamental principle applies to all markets, whether it’s stocks, futures, options, commodities, bonds, or forex currencies.

Why institutional orderflow?

Order flow refers to the number of orders that are waiting to be executed at a particular price level.

Imagine a situation where the price of an asset is rising strongly. However, we know that this upward movement will eventually come to a stop. The reason behind the rally is that there are more traders who want to buy the asset than there are traders who want to sell it. This creates an imbalance in the market, with more buyers than sellers. As a result, the price moves upwards. Eventually, the buying momentum slows down, and the price reaches a level where there are more sellers than buyers. This new imbalance, with more sellers than buyers, causes the price to start moving downwards.

This simple scenario occurs in both macro and micro levels in the market. It’s the basic principle that drives price to either move within a range or reverse its direction.

When you analyze a chart showing the price movement, you can interpret the forces that are acting upon different price levels.

It may seem straightforward when looking at charts after the events have unfolded. However, imagine if you could forecast upcoming price levels with a reasonable degree of accuracy. What if you could know in advance where the opposing order flow would be waiting at a specific time and price?

Having this certainty would enable you to determine the ideal entry and exit points for your trades with precision.

Order flow analysis is a unique concept in trading that can help you predict, with a good level of confidence, where order imbalances will occur at future price levels. This knowledge allows you to enter the market with greater precision and confidence.

Video

The Forex scalpers / institutional orderflow

Are you looking to take your trading skills to the next level? Or want to know more about institutional orderflow?

Look no further!

Our comprehensive trading courses and dynamic community provide the resources and support you need to succeed in the financial markets.

Our experienced instructors will guide you through the fundamentals of trading and help you develop a personalized strategy that suits your goals and risk tolerance.

By joining our community, you’ll have access to a network of like-minded traders who are dedicated to helping you achieve your goals.

Our members-only slack provide the perfect platform to exchange ideas, discuss market trends, and collaborate on trades.

Don’t wait any longer to start achieving your trading dreams.

Join our courses and community today and take your skills to the next level!

Are you looking for a Trusted Regulated Broker?

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker. They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.