Trading futures can be a highly rewarding venture, especially when dealing with popular instruments like the Nasdaq 100 futures.

In this blog, we will dive into the specifics of NQ futures, including how to trade them, their tick values, and important trading hours.

What are NQ Futures?

NQ futures refer to the Nasdaq 100 futures contracts, which represent a portion of the Nasdaq-100 index—a collection of the 100 largest non-financial companies listed on the Nasdaq stock market. These futures allow traders to speculate on the performance of this index, providing opportunities for profit in both rising and falling markets.

Types of Nasdaq Futures

There are several types of Nasdaq futures, including:

- E-mini Nasdaq Futures (E-mini NQ): These are smaller versions of the standard Nasdaq 100 futures contracts, designed to make trading more accessible to retail traders.

- Nasdaq Mini Futures: Similar to the E-mini, these contracts are smaller in size.

- NDX Futures: Another term for Nasdaq 100 futures.

- Nasdaq Emini Futures: A popular choice for day traders due to their liquidity and volatility.

Trading NQ Futures

How to Trade NQ Futures:

- Understand the Basics: Before diving into trading, familiarize yourself with the basics of NQ futures, including their contract specifications and market behavior.

- Choose a Brokerage: Select a brokerage that offers access to CME NQ futures. Ensure they provide robust trading tools and educational resources.

- Develop a Strategy: Whether you prefer day trading, swing trading, or long-term investing, having a solid strategy is crucial.

- Stay Informed: Use resources like the Nasdaq futures live stream and Nasdaq futures now updates to stay on top of market movements.

Key Trading Metrics:

- Tick Size and Value: Understanding the NQ tick size and NQ tick value is essential. For Nasdaq 100 futures, the tick size is 0.25 index points, and each tick is worth $5.

- Point Value: The NQ point value helps traders calculate potential profits and losses. Each point in the NQ futures is worth $20.

- Trading Hours: NQ futures trading hours span nearly 24 hours, allowing for flexibility in trading. However, liquidity is highest during regular market hours.

Specifics of Nasdaq Futures Contracts

NQ Futures Contract:

- Contract Size: Typically, one NQ futures contract represents the value of the Nasdaq 100 index multiplied by $20.

- Expiration: These contracts have quarterly expiration dates.

Nasdaq 100 Futures Mini:

- These smaller contracts offer a lower-cost alternative to standard futures, making them accessible to a broader range of traders.

FAQs about Nasdaq Futures

How Many Ticks in a Point for NQ Futures?

- There are 4 ticks in one point for NQ futures.

What is the Tick Value?

- For NQ futures, each tick is worth $5.

What is the Point Value for NQ Futures?

- Each point in NQ futures is valued at $20.

Conclusion

Trading NQ futures can be a profitable venture if approached with the right knowledge and strategies. Understanding the contract specifics, staying informed with live updates, and using effective trading techniques are key to success. Whether you’re trading NQ emini futures, QQQ futures, or any other Nasdaq futures, the opportunities are vast.

Stay diligent, keep learning, and happy trading!

Join us

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Discord is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

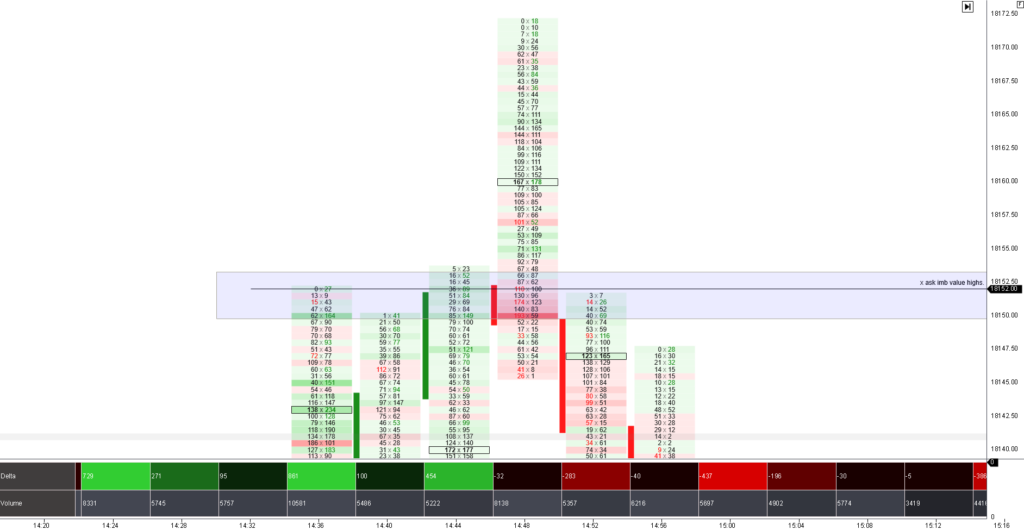

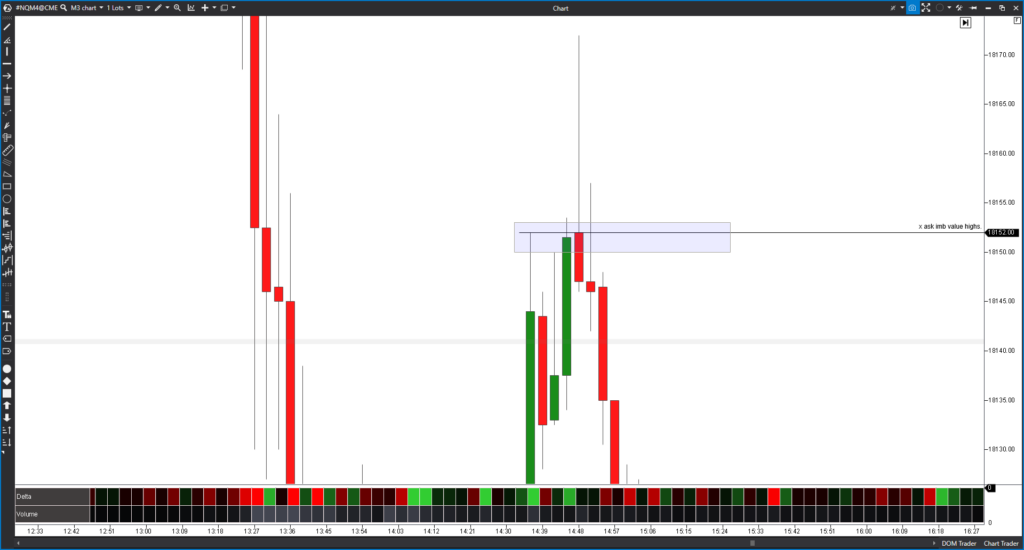

Elevate Your Trading with ATAS. / free order flow trading software

So for those dedicated to mastering the art of trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

Looking for a Trusted Regulated Broker?

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker.

They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.