Central Banks Forex Trading / What is the role?

What is Central Banks Forex Trading?

Central banks are at the center of every country’s financial system since they are the authorities responsible for regulating the supply of money.

And therefore for regulating the functions of the economic sector.

They have evolved from the lack of financial market stability that ruined many economies.

The first central bank was the Riksbank of Sweden, founded in the 17th century, with many followers in the 18th and 19th centuries.

So at the beginning of the 20th century, the United States Federal Reserve emerged.

The positions of central banks in various countries have evolved differently over time.

The key responsibility of the European Central Bank is to maintain price stability by maintaining, as calculated in its CPI, “inflation rates below but close to 2% over the medium term.”

Responsibilities of the Federal Reserve of the United States:

- Conducting the monetary policy of the nation in search of full employment, stable prices, and moderate long-term interest rates by influencing the monetary and credit conditions of the economy.

- Supervising and controlling banking institutions to ensure the stability and soundness of the banking and financial system of the nation and to protect consumers’ credit rights.

- Maintaining the financial system’s stability and containing the systemic risk that may arise from the financial markets.

- Providing financial services, including playing a major role in running the payment system of the country, to depository institutions, the U.S. government, and international official institutions

Central Banks Forex Trading

The most significant economic lever a central bank can regulate is interest rates.

Interest rates are seen as “the price of income” in a traditional economy.

A high-interest rate will attract foreign capital and a low-interest rate will tend to push capital to move.

in a search for a better source of income (higher yields) outside the region.

In organized meetings.

In organized meetings, by voting on the short-term interest rate, the central banks select their desired interest rate.

There are two kinds of interest rates that we should be aware of; the nominal interest rate.

And the discount interest rate at which commercial banks are lent by central banks.

One way a central bank controls interest rates is by open market operations (OMO’s).

OMO’s are essentially an activity of buying and selling that increases or lowers the supply of currency.

Which has an immediate impact on the interest rate and the value of currencies.

Each central bank has its preferred way of manipulating the interest rate through open market operations.

But we will concentrate on the Fed’s approach because it is the easiest and most influential.

Central Banks Forex Trading

Through lending and borrowing collateral securities from 22 banks and bond dealers (called primary dealers), the Fed selects the nominal interest rate (named fed fund target rate).

These practices are known as “Repo” (repurchase operations).

Traders can review the activities of the open market from time to time; they have a big impact on Forex.

The acquisition and sale of US Treasuries are free to market activities.

And the supply of money is regulated by these everyday transactions.

Treasuries are government debt that, at a fixed rate of return, is sold to investors.

So the Federal Reserve holds about half of the US debt, a statistic that seems peculiar to some, with the Central Bank holding half of the country’s debt.

Do you want to become Success Supply and Demand Trader?

Central Banks Forex Trading

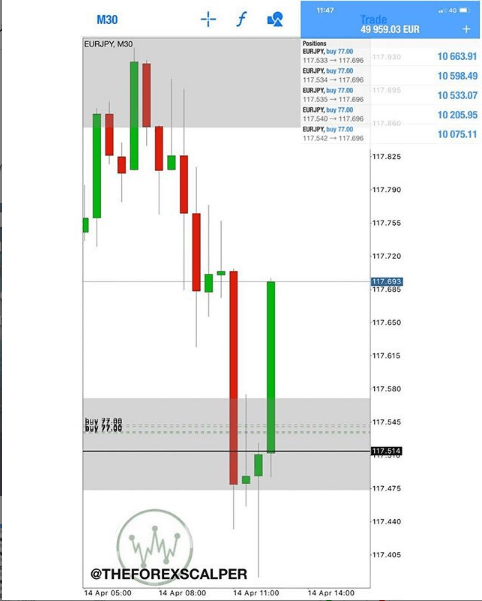

If you are a beginner trader and to become a good professional forex trader.

The Forex Scalper teaches you the best scalping trading strategy using supply and demand zones which is already traded and tested by thousands of TFS members and performs daily trades.

To become profitable from Beginner Trader and most successful Scalping trader in Supply and Demand.

Join THEFOREXSCALPERS and trade with 3500+ community traders with daily analysis and educations which boosts your trading skills make you Professional Forex Market Trader.

Looking for a Trusted Regulated Broker?

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker. They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.