When trading Nasdaq futures, understanding the specific trading times and the movements that occur during these periods is crucial. In this blog post, we’ll explore the trading times of Nasdaq and highlight the significant movements we observe during the New York open. These movements are part of what I call the Algorithm Precision Price Delivery (APPD), a component of Timing Price Orders (TPO), which I explain in detail in The Practicum.

Trading Times of Nasdaq

The Nasdaq market operates almost 24 hours a day, but it’s essential to know the key trading times to maximize your trading strategy. The primary trading session for Nasdaq is from 9:30 AM to 4:00 PM EST, coinciding with the New York Stock Exchange (NYSE) trading hours. However, the most critical times to watch i will all explain in the Practicum.

Key Movements During the New York Open

One of the most significant times for trading Nasdaq futures is during the New York open at 9:30 AM EST. During this period, we often see substantial market movements. These movements are driven by various factors, including the influx of orders from overnight trading, economic news releases, and market sentiment at the start of the trading day.

Introducing Algorithm Precision Price Delivery (APPD)

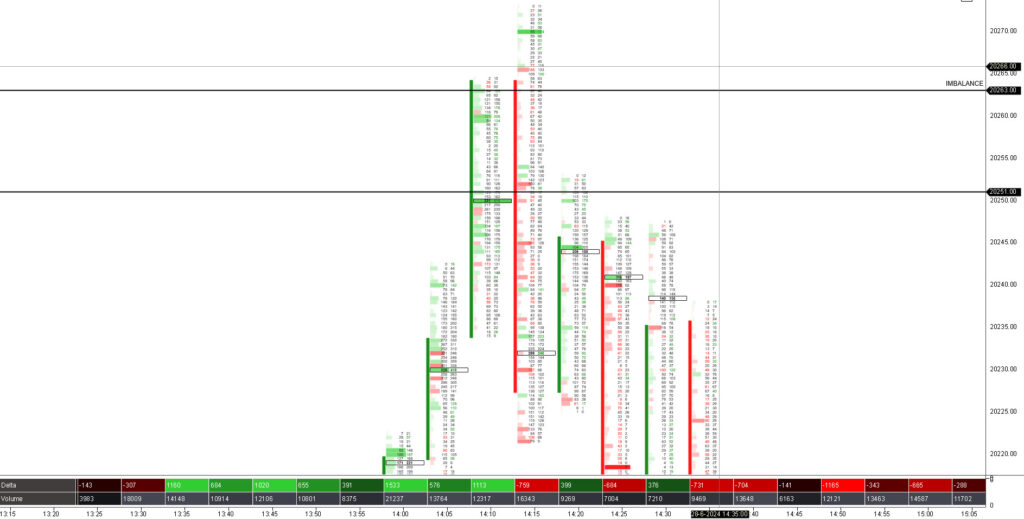

I call these specific and often predictable movements during the New York open the Algorithm Precision Price Delivery (APPD). APPD is a component of Timing Price Orders (TPO), a strategy that focuses on understanding and capitalizing on market movements at precise times.

What is APPD?

APPD refers to the precision with which algorithms drive the price to specific levels during key trading times. This precision is often observed during the New York open, where the market reacts to overnight news, economic data, and the initial orders placed by institutional traders.

The Importance of APPD in Nasdaq Trading

Understanding APPD is crucial for traders because it helps predict and capitalize on the significant price movements during the New York open. These movements can provide excellent trading opportunities, allowing traders to enter and exit positions with greater confidence and precision.

Timing Price Orders (TPO)

Timing Price Orders (TPO) is a broader concept that encompasses APPD. TPO involves analyzing and utilizing the timing of price movements to develop effective trading strategies. By understanding when significant movements are likely to occur, traders can better plan their trades and improve their overall trading performance.

APPD

Learn More in The Practicum

In The Practicum, we delve deeper into APPD and TPO, providing comprehensive explanations and practical examples. We discuss the nuances of Nasdaq trading times and how to use these strategies to your advantage. You’re always welcome to join The Practicum and learn more about these essential concepts.

Conclusion

Understanding the trading times of Nasdaq and the key movements during the New York open is vital for any serious trader. The Algorithm Precision Price Delivery (APPD) and Timing Price Orders (TPO) are crucial concepts that can significantly enhance your trading strategy. By joining The Practicum, you can gain deeper insights into these strategies and improve your trading skills.

If you’re interested in mastering Nasdaq trading and learning more about APPD, consider joining The Practicum. It’s an invaluable resource for traders looking to enhance their knowledge and trading performance.

Join us

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Discord is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

Elevate Your Trading with ATAS. / free order flow trading software

So for those dedicated to mastering the art of trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

Looking for a Trusted Regulated Broker?

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker.

They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.