Learn everything about Orderflow trading?

- theforexscalper

Learn everything about Orderflow trading?

theforexscalper

Email us now :

info@theforexscalpers.com

In the world of finance and trading, you often hear the term “indices.” But what exactly are indices, and why are they important? Let’s dive into the definition, meaning, and how to trade indices in a simple and easy-to-understand way.

An “indice” is another way of saying “index.” In financial terms, an index is a way to measure the performance of a group of assets, like stocks, bonds, or commodities. Think of an index as a big basket that holds various financial instruments, and its value shows how the group of assets is doing overall.

Indices are the plural form of index. They are statistical measures that track the performance of a specific group of assets. For example, the S&P 500 is an index that tracks the performance of 500 large companies listed on U.S. stock exchanges. Other well-known indices include the Dow Jones Industrial Average (DJIA) and the Nasdaq Composite.

Indices are used to give a snapshot of market trends and performance. They help investors and analysts understand how a particular market or sector is performing. For example, if the S&P 500 is going up, it means that, on average, the 500 largest companies in the U.S. are doing well.

In simple terms, indices are tools that show us how well a market or a specific group of assets is performing. They are essential for investors because they provide a way to compare the current market conditions with past performance and make informed investment decisions.

In trading, they are benchmarks used to measure the performance of individual investments. Traders and investors can also trade it directly through financial products like index funds, exchange-traded funds (ETFs), and index futures. Trading indices allows you to gain exposure to an entire market segment without having to buy individual stocks.

There are several ways to trade indices:

Index trading involves speculating on the price movements of indices. Traders can buy or sell index futures, ETFs, or options to profit from changes in the index’s value. This type of trading allows for diversification and can be less risky than trading individual stocks since you are spreading your risk across a basket of assets.

They represent the collective value of a group of assets, which makes them a good indicator of market sentiment. They help traders understand market trends and make informed decisions based on the overall performance of the market or specific sector

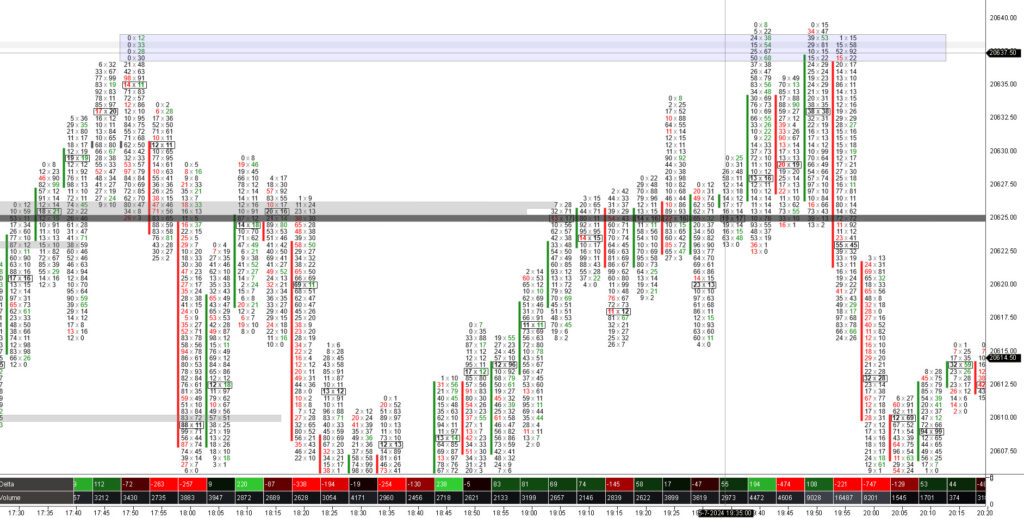

One of the most significant times for trading Nasdaq futures is during the New York open at 9:30 AM EST. During this period, we often see substantial market movements. These movements are driven by various factors, including the influx of orders from overnight trading, economic news releases, and market sentiment at the start of the trading day.

I call these specific and often predictable movements during the New York open the Algorithm Precision Price Delivery (APPD). APPD refers to the precision with which algorithms drive the price to specific levels during key trading times. This precision is often observed during the New York open, where the market reacts to overnight news, economic data, and the initial orders placed by institutional traders.

Timing Price Orders (TPO) is a broader concept that encompasses APPD. TPO involves analyzing and utilizing the timing of price movements to develop effective trading strategies. By understanding when significant movements are likely to occur, traders can better plan their trades and improve their overall trading performance.

They are vital tools in the financial markets, offering insights into market performance and trends. Whether you’re an investor looking to track market performance or a trader aiming to profit from market movements, understanding them is crucial. The ability to trade indices through various financial products makes them accessible and beneficial for a wide range of market participants.

If you’re interested in mastering Nasdaq trading and learning more about APPD and TPO, consider joining The Practicum. In The Practicum, we delve deeper into these concepts, providing valuable insights and strategies for successful trading.

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Discord is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

So for those dedicated to mastering the art of trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker.

They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.

Welcome to my author blog. With over 12 years of experience in the financial markets, Trading is more than a profession for me; it's a passion that has fueled my curiosity and determination. Over the years, I've explored various trading strategies, dabbled in different asset classes, and navigated through the ever-evolving landscape of technology and innovation. Through it all, I've witnessed firsthand the transformation of the financial industry. My mission is to share the wealth of knowledge I've gained over the years with you, my fellow traders and aspiring investors. Whether you're a seasoned pro looking for fresh perspectives or a newcomer eager to understand the basics, you'll find something valuable here.

Success in trading isn’t just a dream — it’s achievable,

and in just 6 weeks, you can be well on your way to becoming a funded trader or growing your own capital.

What’s holding you back from turning your effort into results?

If you’re ready to commit, you’ll have the building blocks you need for real success.

Take the leap, and let’s make it happen together!

Get 15% off on any item when you buy today