Learn everything about Orderflow trading?

- theforexscalper

Learn everything about Orderflow trading?

theforexscalper

Email us now :

info@theforexscalpers.com

Over the last few years the popularity of Gold has increased as an alternative currency exchange. Many traders consider the precious metal as a hedge against inflation and value storage, thus it is often referred to as a “safe-haven” security or investment. Historically, gold prices tend to move in high price with the US dollar, but this connection is most probably because of Covid19. Gold has also started trade relative to other currencies in response to increased in demand.

Gold is one of the financial commodities that are hardest to value. More traded and fluctuates all time with big moves where you can catch hundred of pips. Gold is equivalent to a currency such as the US dollar or the euro because it is robust, affordable, standardized around the world, and generally accepted; however, unlike these more commonly traded currencies, gold is not backed by an underlying economy of people , businesses, and infrastructures. Gold is more comparable in other respects to a product such as oil or corn because it comes from the earth and has uniform physical characteristics. Unlike other goods, however, the gold price also fluctuates independently of its supply and demand in industry.

For centuries it has provided a medium for the preservation of money, and is now easily tradable via gold ETFs. Gold ETFs allow the investor to buy gold and net the benefits of precious metal, ETFs effectively function as a mutual gold fund, with one buying unit containing, in most cases, 1 gram of gold. These units may be exchanged on the stock exchange just like a single share of a business can be exchanged, and sales are usually handled in the same way as a stock buy. Gold Trading ading is more fluctuate than other forex currencies.

On the other hand, Forex trading involves a trader making determined transactions and speculations about the relative value of a pair of particular currencies. For example , a trader on the forex markets may feel the value of the US dollar is about to rise in relation to the euro. The trader would then enact a currency swap through a currency broker, and would only accept a profit if the dollar’s value eventually increases. While both of these investment strategies give the experienced investor the opportunity to make money in both the short and long term, they are two distinct choices that both have remarkable advantages and disadvantages.

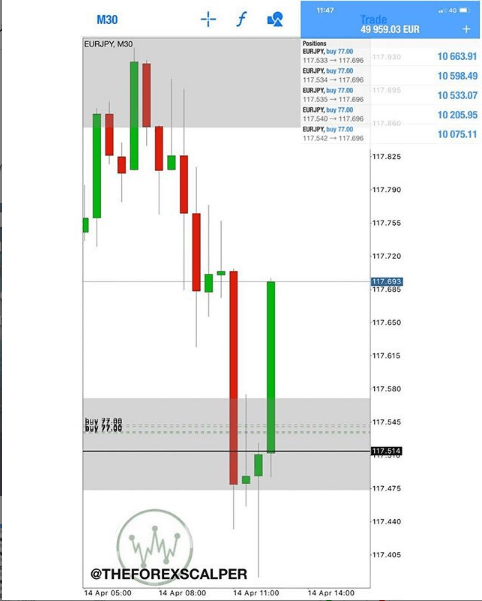

The Forex Scalper teaches you the best scalping trading strategy using supply and demand zones which is already trading by thousands of TFS members and performs daily profitable trades.

To become profitable from Beginner Trader and most successful Scalping trader in Supply and Demand join THEFOREXSCALPERS and trade with 3500+ community traders with daily analysis and educations which boosts your trading skills make you Professional Forex Market Trader.

Welcome to my author blog. With over 12 years of experience in the financial markets, Trading is more than a profession for me; it's a passion that has fueled my curiosity and determination. Over the years, I've explored various trading strategies, dabbled in different asset classes, and navigated through the ever-evolving landscape of technology and innovation. Through it all, I've witnessed firsthand the transformation of the financial industry. My mission is to share the wealth of knowledge I've gained over the years with you, my fellow traders and aspiring investors. Whether you're a seasoned pro looking for fresh perspectives or a newcomer eager to understand the basics, you'll find something valuable here.

Success in trading isn’t just a dream — it’s achievable,

and in just 6 weeks, you can be well on your way to becoming a funded trader or growing your own capital.

What’s holding you back from turning your effort into results?

If you’re ready to commit, you’ll have the building blocks you need for real success.

Take the leap, and let’s make it happen together!

Get 15% off on any item when you buy today