One powerful tool that traders rely on is the concept of Market Delta. Market Delta offers a footprint of trading activity, showing the balance between buyers and sellers and giving traders insights that can’t be found on typical candlestick charts. In this post, we’ll break down what Market Delta is, how it works, and the different tools available, such as Market Delta Footprint and Delta Software.

What is Market Delta?

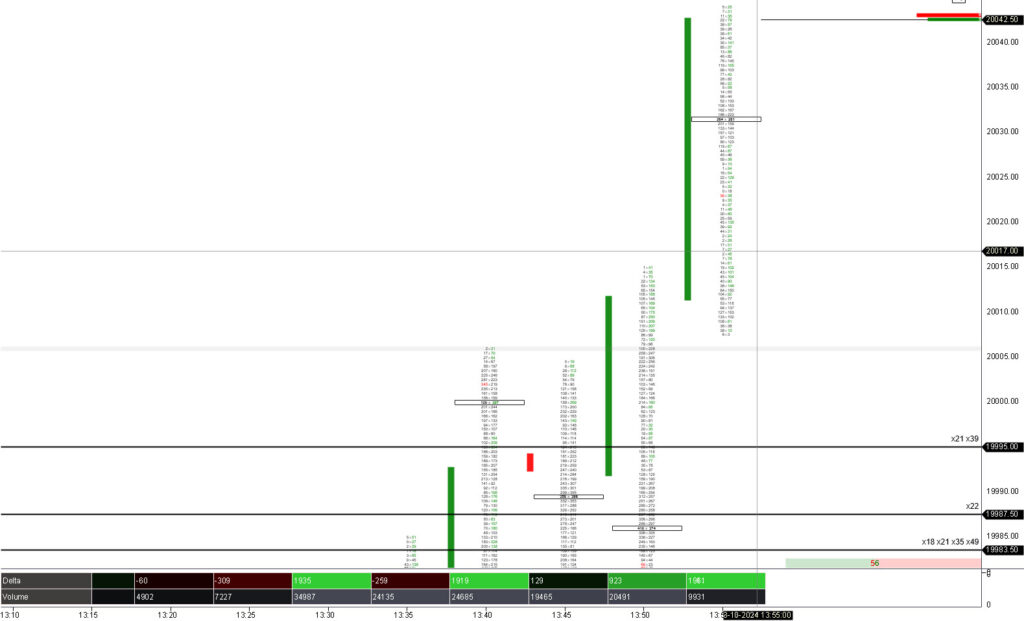

Market Delta is a tool used to analyze the net difference between buying and selling volume at a given price level. It helps traders understand whether buyers or sellers are in control in a particular moment. By tracking buying and selling pressure, Market Delta provides a clearer picture of potential market reversals, breakouts, and trends, which can be incredibly helpful for making quick trading decisions

How Market Delta Footprint Charts Work

A popular way to view Delta data is through Market Delta Footprint charts. These charts show traders the exact volume traded at each price level and break down the difference between buy and sell orders. This information, known as “footprint data,” allows traders to see whether buyers or sellers dominate at each price level, which can signal potential support or resistance points.

For example, if a Delta Footprint shows that there is a higher volume of buy orders at a certain price, it could indicate strong buying interest and hint that the price might increase. On the other hand, if sell orders dominate, it could mean a possible price drop.

Why Use Delta Software?

Market Delta Software is designed to provide traders with an intuitive way to analyze and interpret market delta information. With specialized software, traders can visualize delta data in real-time, which is essential for scalping, day trading, and other strategies that require quick responses. Delta Software offers different types of charts, such as volume footprint charts and delta profile charts, that help traders make informed decisions with more clarity and precision.

Using Market Delta Software can help traders:

- Spot real-time shifts in buying or selling pressure

- Analyze high-volume zones, indicating strong supply or demand

- Identify potential reversals based on sudden shifts in delta

This software is ideal for traders who want to have a deeper understanding of the market’s microstructure and improve their decision-making.

Key Benefits of Delta and Market Delta Footprint

- Better Market Insight: Market Delta tools provide a more detailed view of market activity than traditional charts, giving traders a competitive edge.

- Informed Decision-Making: By using Delta Footprint, traders can see where significant buy or sell pressure exists, which helps them make smarter trade entries and exits.

- Efficient Strategy Building: Market Delta Software allows for easier strategy creation and analysis, especially useful for those using volume-based or delta-based strategies.

Final Thoughts

Market Delta and its associated tools, such as Delta Footprint and Market Delta Software, provide traders with a unique view of the market. Whether you’re a day trader looking to optimize entry and exit points or a swing trader interested in understanding market sentiment, these tools can offer a valuable advantage. By using Market Delta, you’re not just relying on price movements alone but also on the underlying trading activity that drives these movements.

If you’re new to Delta or curious about improving your trading strategies, it may be worth exploring these tools further to see how they can enhance your trading approach.

Join us

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Discord is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

Elevate Your Trading with ATAS.

So for those dedicated to mastering the art of trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

Looking for a Trusted Regulated Broker?

TheForexScalper recommends you join ICMARKET which is regulated and the most trusted broker.

They provide very tight raw spread account with fast execution and having multiples deposit and withdrawal options.