Introduction

Having access to comprehensive market data can make the difference between success and missed opportunities. Level 2 market data is an invaluable resource for traders looking to gain deeper insight into market activity.

In this guide, we’ll explore what Level 2 data is, how to access it for free, and how it can sharpen your trading decisions.

What is Level 2 Market Data?

Level 2 market data offers a detailed view of the order book for securities, displaying real-time bids and asks beyond the top price quotes. Unlike Level 1 data, which only shows the highest bid and lowest ask, Level 2 data reveals the full range of prices that traders are willing to buy or sell a stock – a crucial indicator of supply and demand.

Accessing Level 2 Data Without the Cost

For traders on a budget, finding free Level 2 quotes and data is a boon. Many platforms offer free trials or complimentary access to Level 2 data, allowing you to benefit from this detailed information without an upfront investment. These free insights can be particularly helpful for individuals engaged in Level 2 investing, who rely on real-time data to make quick trading decisions.

Adding to these resources, we proudly offer a comprehensive practicum that includes free access to Level 2 data. This is more than just a trial; it’s a full-fledged introduction to integrating Level 2 insights into your trading routine, allowing you to make decisions backed by a deeper understanding of market dynamics. It’s an empowering step toward confident trading, provided with the understanding that when you thrive, the whole trading community gets stronger.

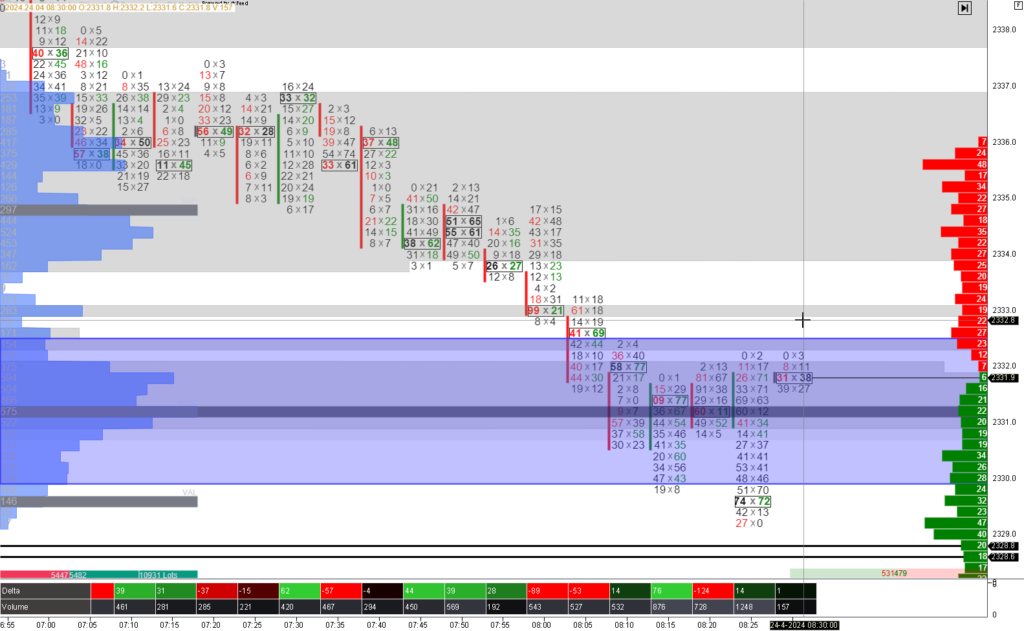

In the picture above you can see the DOM on the right!

Think of the DOM, or Depth of Market, as a list at a busy supermarket that shows you how many apples are for sale and at what price. Only instead of apples, we’re talking about for example shares of companies. The DOM shows you not just the best prices available but all the other prices where people are waiting to buy or sell. It’s like seeing a line at each checkout lane and knowing which one will get you out the fastest or give you the best deal.How It Connects to Level 2 Data

Level 2 data is like having a VIP pass to see the supermarket’s list. It gives you a peek into where the lines are longest or shortest and at what prices people are really willing to trade. So, with Level 2 data, you’re not just seeing the advertised special offer; you’re getting to see every price on every shelf. This can help you decide when to jump into the line to buy or sell those shares yourself.

With this info, you can make smarter decisions, like figuring out if you should wait a bit longer because the price might drop, or if you should buy quickly before the price goes up because lots of people are starting to show interest.

Deciphering the Data: A How-To

Level 2 market data might look a bit overwhelming at first, kind of like a puzzle waiting to be solved. Think of the order book as a big to-do list that the market keeps updating every second. It shows the prices that people are willing to buy and sell shares for, along with how many shares they want to deal with. This list is really a sneak peek into what people are thinking about a stock’s price and can give you some hints about where the price might go next.

To help you figure it all out, we’ve put together something special: the Whale Order Book and a course that goes with it. Think of it as your map and compass for the world of Level 2 data. Our course is easy to follow and teaches you how to spot the really big deals that can make a splash in the market, just like how whales make waves in the ocean. These big deals are important to watch because they can tell you a lot about what might happen next with stock prices. If you want to get good at understanding the market’s moves, this course is for you.

Practical Use Cases for Traders

How can you use this data to your advantage? Level 2 data allows traders to spot potential Supply and Demand levels by showing where large numbers of buy or sell orders are clustered. By analyzing free Level 2 stock quotes and stock data, you can better understand the strength behind price movements and adjust your trading strategy accordingly.

Comparing Level 1 and Level 2 Data

While Level 1 data provides a snapshot of current prices and volume, Level 2 data stocks reveal who is looking to trade at different prices, and how much they are willing to trade. This depth of information can be particularly helpful in nascent trading strategies, such as those used in NASDAQ Level 2 markets, where precision and speed are critical.

Strategies for Level 2 Trading

Traders can leverage Level 2 market data free to enhance their trading techniques. By observing the flow of orders, you can gauge market sentiment and better predict short-term price movements. The key is to understand the nuances of Level 2 trading data and adapt your approach accordingly.

Finding the Best Level 2 Data Sources

Wondering where to find top-notch Level 2 market data? There’s a wealth of sources out there, from online brokerages to specialized trading platforms. For instance, TD Ameritrade’s thinkorswim platform is well-known for its detailed Level 2 data, which is super helpful whether you’re into options trading or like to day trade stocks.

But here’s a pro tip: the best way to get to grips with Level 2 data is by using it in real-life scenarios. That’s why our practicum includes not just the discord but also practice accounts. You’ll get your hands on live Level 2 data, simulating real trading without any risk. It’s like having a test drive in the stock market’s fast lane, allowing you to learn and practice until you’re ready to hit the road for real.

Conclusion:

Whether you’re using Level 2 data to trade stocks or options, the depth and insight it provides can be incredibly powerful. By taking advantage of free resources and dedicating time to understand and interpret Level 2 information, you can significantly improve your chances of success in the market.

Remember, practice makes perfect. Dive into Level 2 data with a curious and analytical mind, and watch as your trading skills grow alongside your confidence.

Join us

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Slack channel is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

Elevate Your Trading with ATAS.

So for those dedicated to mastering the art of futures trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.