What’s Market Depth All About?

Imagine you’re at a big concert and you want to get to the front row.

Market depth is like knowing how many people are in front of you and how hard it might be to get through them.

For trading, it’s about seeing how many other traders want to buy or sell a stock, and at what prices. If lots of people are looking to trade, we say the market is ‘deep’ and it’s easier to trade without changing the price too much.

Think of market depth as a big list, kind of like a preorder list for a new game or gadget. It shows all the orders that traders have placed but that haven’t been bought or sold yet. This list is super useful because it shows us the buzz around a stock and what might happen next.

Making Sense of Market Depth

Understanding market depth means you’re keeping an eye on this list, watching the supply (sellers) and demand (buyers), and trying to figure out where the price might go. Will it zoom up because everyone wants to buy it? Or will it drop because everyone’s trying to sell?

Let’s say you’ve got a super popular stock, like a hot sneaker brand everyone wants. Because everyone’s buying and selling, you can jump in and buy a bunch without making the price jump up. That’s a liquid stock with a lot of depth.

But what if it’s a stock from a small, unknown company? It’s like a secret club – not many people are trading, so if you suddenly want to buy a lot, the price can shoot up just because you’re buying.

How Can You Peek at Market Depth?

A lot of trading sites show you market depth for free or for a small cost. It’s like getting a VIP pass to see the whole list of orders, not just the top few. You can see who wants to trade, how much they want to trade, and at what price, all updating as fast as texting your friends.

Why Do People Care About Market Depth?

Some really big companies, like those making smartphones or running search engines, have tons of traders interested in them. This means you can trade big without making a ripple. But for smaller companies, a single big trade can make waves.

By keeping an eye on market depth, you can spot chances to buy or sell just at the right time, maybe when a new company starts selling shares and everyone’s deciding how much they’re willing to pay.

What’s It Look Like in Real Life?

Let’s say you’re watching a stock – let’s call it ‘Gizmo Corp.’ It’s selling at $1.00, but you see there are loads of people willing to buy at $1.05, even more at $1.08, and a few at $1.10. On the flip side, only a few folks want to sell for less than a dollar.

Looking at that, you might think, “Huh, Gizmo Corp’s price might go up soon.” So, you can decide if now’s the time to jump in and grab some shares or maybe sell the ones you have if the price gets high enough for you.

DOM in Trading: Your Lens for Precision

When trading stocks, futures, or any other instruments, the DOM gives you a high-resolution image of the market’s current mood. It lists all buy and sell orders for an asset lined up with their price levels. This information is crucial; it’s like knowing all the players in a chess game and the moves they’re planning.

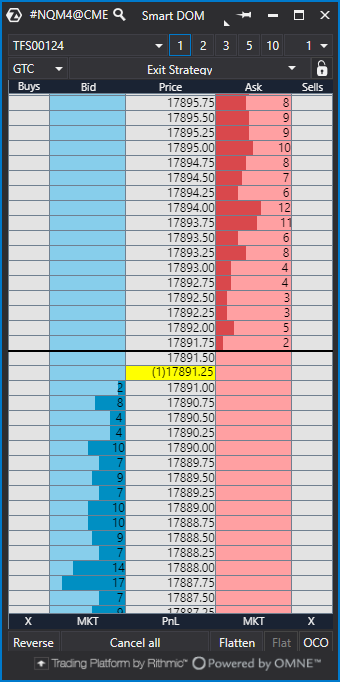

Take a look at this snapshot of a DOM, your go-to tool for reading the market’s pulse. Just like a scoreboard at a game, it shows the current buy and sell orders at different prices. Reading it is simple: the numbers on the left tell you how much people want to sell and for how much, while the right side shows you what buyers are willing to pay. Use this info to make smart moves and trade with the confidence of having insider knowledge!

Market Depth: The Trader’s Gauge

Market depth is another term for this layered insight. It’s the gauge savvy traders use to measure the potential supply and demand at various price points. A market with deep depth means there’s a large volume of trades at each price level, suggesting a stable or liquid market.

DOM Futures Trading: A Crystal Ball?

For futures traders, the DOM is akin to a crystal ball. It allows them to forecast with greater accuracy how a futures contract might move. By seeing the volume of orders at different prices, they can predict potential price movements and set their strategies accordingly.

Trading the DOM: Strategies Unveiled

Trading the DOM involves more than just observation. It’s about strategic action. By understanding how to interpret and respond to the information in the DOM, traders can place orders that capitalize on the revealed market depth, potentially gaining an edge over those trading without this valuable insight.

Decoding the DOM: An Invaluable Skill

So, what is the DOM in trading? It’s not just a passive tool — it’s an active ally. Knowing how to decode the DOM’s wealth of information can inform your trading decisions, timing, and even the selection of your entry and exit points.

Conclusion:

The DOM isn’t just for seasoned professionals. With a bit of study and practice, any trader can learn to navigate its depths. As you begin to trade the DOM, you’ll find it’s more than data — it’s a narrative of the market’s ebb and flow, a story where you can decide the ending.

Join us

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Slack channel is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

Elevate Your Trading with ATAS.

So for those dedicated to mastering the art of futures trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

Questions?

Questions?

16 Replies to “Depth of market: Understanding the DOM in Trading.”