Learn everything about Orderflow trading?

- theforexscalper

Learn everything about Orderflow trading?

theforexscalper

Email us now :

info@theforexscalpers.com

Order book

Today, we’re diving into the world of order books. No, it’s not the reservation list at your favorite restaurant, but it’s just as important—if not more—for people in trading and business. Stick around, and I promise to keep the finance jargon to a minimum!

So, what exactly is an order book? Picture a bustling market where everyone’s shouting buy and sell orders for apples. An order book is like a detailed list where all these shouts are neatly written down, showing who wants to buy or sell apples and at what price. It’s not just for apples, of course, but that’s the gist of it!

In business, an order book keeps track of all orders a company receives and needs to fill. Imagine if Amazon forgot who ordered that last PlayStation—chaos would ensue! Businesses use order books to keep everything from turning into a retail apocalypse, helping them plan better and manage their stock.

In the trading world, the order book is where all the action happens. Traders glance at the order book to see where the market’s heading—kind of like checking the wind before sailing. They use this info to decide when to jump in and buy or sell, trying not to crash their financial boats.

Is it “order book” or “orderbook”? Well, whether you write it as one word or two, you’re still talking about the same handy tool. It’s just like arguing if it’s donut or doughnut—equally delicious, slightly different spelling.

It’s trading based on insights gained from, you guessed it, the order book! Traders look for patterns and prices to make smart moves and hopefully, not end up crying over lost money.

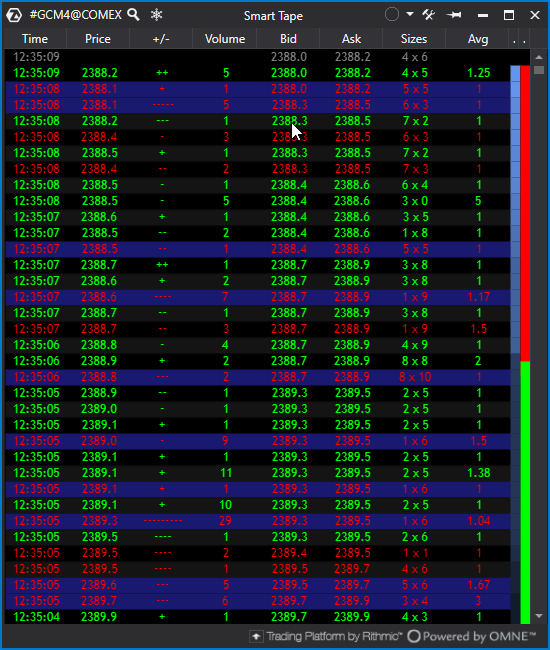

Reading an order book is like trying to read your grandmother’s recipe written in her secret shorthand. Just kidding! It’s simply about looking at numbers: where the prices are high, where they’re low, and how many people are buying or selling at these points.

An order book is a tool used in trading that has three main parts: buy orders, sell orders, and order history.

At the top, you will find the highest bid price (the most someone is willing to pay) and the lowest ask price (the least someone is willing to sell for). These prices help determine the current market price. An order book is often paired with a candlestick chart, which provides a visual representation of the market’s current and past performance.

It helps traders make better decisions by showing:

For example, if there are many more buy orders than sell orders, it may suggest that the stock price will rise. Traders can also identify potential support levels (prices where many buy orders are clustered) and resistance levels (prices where many sell orders are clustered).

While the order book is designed to be transparent, it doesn’t show everything. One key missing element is “dark pools,” which are hidden orders from large players who don’t want their intentions known. Without dark pools, big trades could significantly impact stock prices. Dark pools help prevent price drops by keeping large transactions hidden until they are completed. This limitation means the order book might not fully represent the actual supply and demand.

Joining our community opens the door to a network of enthusiastic traders, all focused on mutual success. Our exclusive members-only Discord is your arena for exchanging ideas, dissecting market trends, and fostering collaborations. That can turn trading visions into reality.

Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses. It’s time to transform your trading dreams into your reality.

Join our courses and community today and take your skills to the next level!

So for those dedicated to mastering the art of futures trading. ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

Welcome to my author blog. With over 12 years of experience in the financial markets, Trading is more than a profession for me; it's a passion that has fueled my curiosity and determination. Over the years, I've explored various trading strategies, dabbled in different asset classes, and navigated through the ever-evolving landscape of technology and innovation. Through it all, I've witnessed firsthand the transformation of the financial industry. My mission is to share the wealth of knowledge I've gained over the years with you, my fellow traders and aspiring investors. Whether you're a seasoned pro looking for fresh perspectives or a newcomer eager to understand the basics, you'll find something valuable here.

Success in trading isn’t just a dream — it’s achievable,

and in just 6 weeks, you can be well on your way to becoming a funded trader or growing your own capital.

What’s holding you back from turning your effort into results?

If you’re ready to commit, you’ll have the building blocks you need for real success.

Take the leap, and let’s make it happen together!

Get 15% off on any item when you buy today