Learn everything about Orderflow trading?

- theforexscalper

Learn everything about Orderflow trading?

theforexscalper

Email us now :

info@theforexscalpers.com

How to trade US30?

The US30 tracks the performance of the 30 largest companies traded on the New York Stock Exchange.

Due to the nature of its composition, this index is often considered a benchmark of the overall performance of the US economy.

I am personally a big fan of trading US30 in addition to trading forex pairs.

It is especially nice to trade from the lows to the highs and from the highs to the lows.

Have you never traded it yourself?

Then it is highly recommended.

It is much less aggressive than gold, for example.

In this blog I will tell and explain a few things about trading this.

And I hope that at the end of this blog you will understand a little more about the behavior of it and can apply it in your own trading.

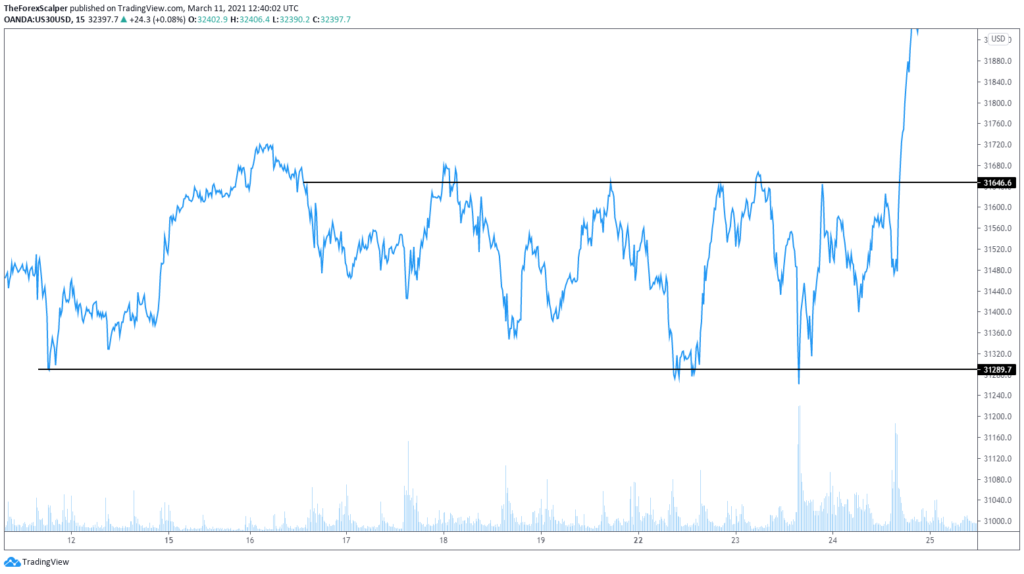

Linechart. How to trade US30?

I’ll start with the US30 line chart in the example above.

You see how the price ranks between the 2 lines for a while.

Before it finally breaks out of range again.

We see this behavior very often and this is also important to take into account.

Even if you look back in the past on the chart, we often see these ranging patterns.

You can often take multiple trades in such a ranging period (Buy and Sells).

This is what makes trading it so attractive.

Above I added the chart with the candlesticks and of course the Supply and Demand zones.

Do you see how many great trades you could have taken from the Supply and Demand zones in this ranging period?

It does not make as many fake outs as gold, for example, so you have to pay attention to other things than gold.

What we pay particular attention to that there are the possible signs of a reversal in the Supply and Demand Zones.

Again, we pay attention to a number of points before we can take a possible Sell or Buy on.

For example, pay attention to the volume, do you see those higher spikes when it breaks through the zone at the top and then comes back down again?

These can often be signs of a possible reversal.

Of course you check this together with a few other important points.

We see above this supply zone is another important liquidity level / line where we know that the price will probably touch it first before the price will reverse again.

This is also an important point to consider before you buy or sell.

How to trade US30?

These are just a few of the points where I am all looking out for a trade open.

Many members also know how to recognize these and now use them.

Soon I will be blogging about the behavior of a specific forex pair.

Can’t wait for that?

Then start the course now and I will explain everything in detail and if you use the code ‘15% off’ you will now also get a 15% discount on the course.

The US30, or Dow Jones Industrial Average (DJIA), is one of the oldest and most widely followed stock market indexes in the world. Established on May 26, 1896, by Charles Dow, serves as a barometer for the overall health. Of the United States stock market and the economy. It is composed of 30 large publicly-owned companies based in the United States. Spanning a diverse range of industries except for transportation and utilities, which are covered by other Dow Jones indexes.

The composition of the US30 is not fixed; it changes over time to reflect the evolving U.S. economy. Companies are selected for inclusion in the index by a committee that considers factors such as market capitalization. Liquidity, and the company’s significance within its industry. This selection process ensures that it continues to represent the leading companies in the U.S. economy. Making it a critical reference point for investors around the globe.

The US30 is a price-weighted index, meaning that companies with higher stock prices have a more significant impact on the index’s performance than those with lower stock prices. This method is different from other major indices, such as the S&P 500, which are market capitalization-weighted. The price-weighted approach gives an interesting perspective on the market, though it also means that the index might not perfectly reflect the market’s overall size or the economy’s total value.

Investors and analysts closely watch the US30 for several reasons. It provides a snapshot of market trends and investor sentiment towards blue-chip companies. Movements can signal changes in economic outlook, shifts in consumer behavior, or reactions to domestic and international events. Additionally, because it includes companies from various sectors, the performance can offer insights into the relative strength of different areas of the economy.

However, the US30 is not without its critics. Some argue that because it includes only 30 companies, it may not provide as comprehensive a view of the market as broader indices. Additionally, the price-weighting methodology means that the index can be disproportionately influenced by the performance of a few high-priced stocks.

Despite these criticisms, the US30 remains a key indicator for investors, policymakers, and the public. Its long history and the prominence of its constituent companies ensure that it will continue to be an essential tool for understanding the U.S. stock market and economic trends.

In conclusion, with its storied history and critical role in the financial markets, offers invaluable insights into the health and direction of the U.S. economy. It stands as a symbol of American industrial strength and a testament to the dynamic nature of the U.S. stock market. Whether you are a seasoned investor or just starting to explore the financial markets.

How to trade US30?

Because we don’t stop there. For those ready to take a significant step forward, we invite you to explore the opportunity with our proprietary trading firm. TFS Funding. This platform is designed for traders who are eager to leverage their skills on a larger scale. O ffering the capital and support needed to flourish in the markets. Don’t let another moment pass in hesitation. Embark on your journey to trading excellence today by enrolling in our courses, engaging with our community, and seizing the opportunity with TFS Funding. It’s time to transform your trading dreams into your reality. Join TFS Funding Here – Unlock the door to advanced trading opportunities and elevate your skills to the professional level with TFS Funding. Join our courses and community today and take your skills to the next level! Elevate Your Trading with ATAS. So for those dedicated to mastering the art of futures trading, ATAS is more than a platform. It’s a partner in your journey towards trading excellence. Its blend of sophisticated analysis tools, customizable features, and supportive community. This makes ATAS the recommended choice for traders aiming to leverage the full potential of the futures market.

Welcome to my author blog. With over 12 years of experience in the financial markets, Trading is more than a profession for me; it's a passion that has fueled my curiosity and determination. Over the years, I've explored various trading strategies, dabbled in different asset classes, and navigated through the ever-evolving landscape of technology and innovation. Through it all, I've witnessed firsthand the transformation of the financial industry. My mission is to share the wealth of knowledge I've gained over the years with you, my fellow traders and aspiring investors. Whether you're a seasoned pro looking for fresh perspectives or a newcomer eager to understand the basics, you'll find something valuable here.

Success in trading isn’t just a dream — it’s achievable,

and in just 6 weeks, you can be well on your way to becoming a funded trader or growing your own capital.

What’s holding you back from turning your effort into results?

If you’re ready to commit, you’ll have the building blocks you need for real success.

Take the leap, and let’s make it happen together!

Get 15% off on any item when you buy today